Nuclear: Time for open competition

Government's downgraded forecast for nuclear power, plus industry spooking, points to auction solution

By Richard Black

Share

Last updated:

The forecasts for UK energy and carbon emissions that government released a few days back make interesting reading – not least on nuclear power.

So do recent noises from the nuclear industry.

Putting the two together raises an intriguing question: Could a sensible, cost-effective and fair solution to its nuclear electricity conundrum be staring ministers in the face?

Powering down

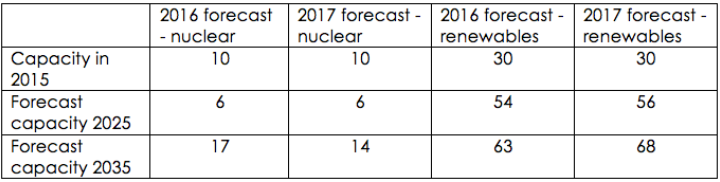

Let’s start with those forecasts from the Department for Business, Energy and Industrial Strategy (BEIS). In comparison with previous forecasts, this year’s downgrades expectations for new nuclear power stations.

Last year, BEIS believed that the UK power system would be toting 17 gigawatts (GW) of nuclear capacity in 2035.

That’s now shrunk to 14GW. It’s basically one fewer projected new power station; and if you go through the annual figures, it’s one of the near-term ones that’s dropped out of forecasts (2027 completion, to be precise).

Along with this fall in nuclear expectations comes an upwards adjustment to the amount of renewable generation capacity BEIS expects to come onstream - though it still envisages the build rate falling in the late 2020s.

The reason that’s traditionally given for forecasting a slowdown in renewable build is that a new generation of nuclear reactors will come along that will be cheaper, effectively undercutting renewables.

Out in the real world… how’s that looking?

Divergent paths

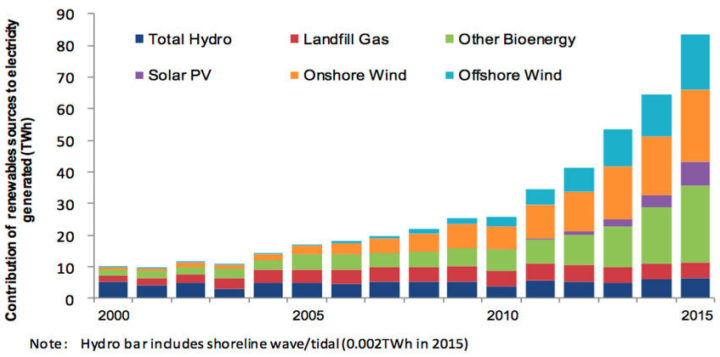

As we showed in a 2015 report, the estimated cost of building new nuclear power stations is on an upwards trajectory – the costs of renewables on a downwards one.

Since then, the picture has become even starker, with EDF revising upwards its cost projections for Hinkley Point C. Meanwhile, offshore wind power auctions are producing spectacularly low winning bids – and our recent analysis showed that new wind farms onshore would not now require subsidies at all.

So, the re-jig of BEIS’ projections is undoubtedly heading in a more credible direction. In particular, it’s abandoned its earlier assumption that renewable capacity wouldn’t expand at all 2028-2035, which – given the likely costs, technological advances and growing flexible demand – was literally incredible.

Nuclear hole

Still, we are left with an uncomfortable situation.

That 14GW of nuclear capacity would leave a big hole if it didn’t happen.

Yet, as the government has tacitly acknowledged by downgrading its nuclear forecast, there's no certainty over any of the proposed power stations.

If we assume that Hinkley C is now happening and go through the rest of the candidates on a plant-by-plant basis:

- Hitachi says it may stop preparatory work on Wylfa (Anglesey) this year if it doesn’t get a support package from government – which would scupper its Oldbury (Gloucestershire) plans too

- South Korea’s Kepco is in talks to buy the Moorside project in Cumbria from financially troubled Toshiba. If it does buy, Tepco is likely to use its own reactors, which haven’t even entered the UK’s regulatory approval process yet

- Sizewell C (Essex) should be a near-clone of Hinkley C – which may be a source of optimism or pessimism, depending on your view of Hinkley - and a minimum condition for Sizewell happening is that Hinkley has to succeed

- Bradwell (Essex) hinges on continuing Chinese interest in nuclear power and, in particular, in light water reactors, which is not guaranteed – and on the Chinese reactor gaining UK regulatory approval.

Cost sensitivities

There’s no doubt that the government is sensitive to the charge that Hinkley is just too expensive.

The nuclear industry, though, is sensitive to the same charge. It’s also been spooked by the offshore wind contracts awarded last year at £57.50 per MWh – less than two-thirds of the Hinkley price. Rolls-Royce’s assiduous lobbying operation on behalf of its small modular reactor proposals – which includes a speculated cost of £60/MWh – has intensified the shadow looming over big nuclear.

…All of which resulted in nuclear industry chiefs promising last month that they would aim to reduce costs ‘by up to 30%’ by 2030. More recently, EDF told The Times that it expects to be able to build Sizewell C for 20-25% less than Hinkley – basically because it will already have done Hinkley – reducing the price of its electricity to about £70/MWh.

Time for auction?

Just possibly, all this is presenting ministers with a massive opportunity.

The government is, as we know, keen on competition when it comes to offshore wind power. And here, competition has proven its worth, being widely cited as the main reason why costs have tumbled.

So, why not simply set up a competitive auction process for fixed-price contracts for the nuclear stations that the government believes we need, just as it did with offshore wind?

Hinkley aside, we have five nuclear projects bidding for four slots. The government could simply say something like: ‘Ok, we’re going to have one auction every two years from 2019 to 2025. To enter, you’ll have to have regulatory approval for your reactor and planning permission. If you win, you’ll have eight years to get your power station up and running, or incur penalties.’

It's what Sir John Major would have called 'put up or shut up'.

Looking more broadly, there is a school of thought that says none of the nuclear stations should be built because the entire rationale for baseload power, in an age of increasingly flexible generation and consumption, is disappearing – and that on economics alone, new nuclear power will never compete with the alternatives.

The government doesn’t believe this, which is why it’s still projecting a big role for nuclear going forward.

Well, then: if it believes ‘firm’ power is needed, why not allow non-nuclear ‘packages’ that make up a ‘firm’ power offer to compete on equal terms?

You could, for example, have a package of offshore wind farms, storage and peaking gas-fired power stations, of capacity equal to the proposed nuclear station, competing with it on a level playing field. Allow SMRs, if they ever come close to reality, to compete too. Ditto, fusion. CCS. Give unabated gas a penalty for carbon emissions, give more flexible packages a discount because they’re more flexible. Whatever.

It’s an idea that Dieter Helm hints at in his recent government-commissioned cost of energy review, but without making the logical steps of a) allowing companies to bid in with ‘packages’ of technologies, or b) carbon penalties and flexibility discounts.

BEIS’ latest forecasts are more credible than in years gone by, and that’s to be applauded. But as things stand, they still rely on projections for nuclear power that are teetering on the edge of unbelievability, while eschewing, for nuclear projects, those very market mechanisms that have brought costs tumbling down in other sectors. Oh, and currently, there’s no Plan B.

The nuclear industry would hate competition, of course. But in whose interests is the government supposed to act – the industry’s, or ours?

Share