Electric cars: What's happened to the ads?

Britain is supposed to be heading to electric motoring... but manufacturers aren't driving us there

By Matt Finch

Share

Last updated:

Something has gone missing in the UK's drive towards zero-carbon motoring: advertising.

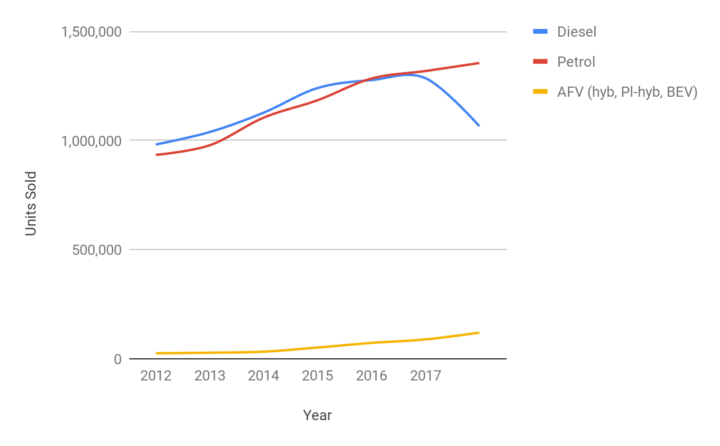

The DNA of the UK’s car fleet is changing. Whereas every car once had a tailpipe, that is no longer the case. Total UK car sales have declined recently, and a more detailed look at the figures reveals some interesting trends:

On the above graph electric vehicles (which includes all hybrids) are represented by the yellow curve, while petrol and diesel sales are represented by the red and blue curves respectively. You can clearly see just how dramatic the recent plunge in new diesel sales has been. And it’s equally clear that electrified vehicle (EV) sales are beginning to increase quite dramatically, albeit from a low base.

This rise in EV sales is impressive on a number of levels. Clearly there is a pre-existing level of demand for electrified vehicles; it turns out that some people want environmentally friendly cars that have dirt-cheap running costs and are often quite cool to boot.

However, demand can be induced – in particular, by companies' marketing efforts. Spend more on advertising a particular product or set of products, and more will be demanded; this is after all what advertising is for.

This leads to interesting questions: are car manufacturers themselves trying to increase demand - and if they're not, why not?

Heading downhill

Judging by advertising spend, the unequivocal answer right now must be 'no'.

Using figures shared with ECIU by the European think-tank Transport and Environment (T&E), we can reveal that advertising spend in the UK on electric vehicles actually fell last year compared to the year before - both in absolute terms, and in the percentage of the overall advertising spend:

Money spent on advertising different types of vehicle

Internal Combustion Engine | Hybrids | Plug-In Hybrids | Zero Emission Vehicles | Combined Electric | |

2017 (€m) | 325 | 8.4 | 5.5 | 5.5 | 19.4 |

2016 (€m) | 360.5 | 11.7 | 9 | 7.8 | 28.5 |

2017 (% of total spend) | 94.3 | 2.4 | 1.6 | 1.6 | 5.6 |

2016 (%) | 92.7 | 3.0 | 2.3 | 2.0 | 7.3 |

Transport and Environment June 2018, ECIU percentage calculations

Put more bluntly, manufacturers spent 32% less in 2017 on advertising electric vehicles than they did in 2016. For comparison, they reduced spending on advertising combustion vehicles by 10%.

T&E found that across the EU's five biggest car markets (including the UK), hybrid and electric cars made up just 3% of the industry's advertising spend. And this despite the fact that there is clearly a market out there, with 30% of the public expressing their willingness to buy an EV. Even in Norway, where 40% of new car sales are electric, car companies spent just 10% of their advertising budget on non-fossils.

T&E's conclusion: companies' advertising spend follows demand rather than maximising a new market opportunity, even when that would be in their own long-term interest (as well as society's).

I say 'would be in their long-term interest' because it is clear, as I have highlighted before, that a whole host of new car manufacturers are coming. Even if established manufacturers are sanguine about competition from the Googles or Dysons of this world - and arguably they should not be - then Chinese companies' plans to dominate the global EV market should logically have them doing every single thing they can to accelerate their own transitions so they have any hope of competing.

Heading into reverse?

There is, of course, no law that says car manufacturers have to spend anything at all on advertising either combustion or electric vehicles in the UK. But why would they not promote EVs? They are, after all, the future (even ministers think so, having recently announced that all of the Government's car fleet will meet ‘ultra-low’ emission standards in just 12 years' time).

One reason why spending may have dropped is that they don’t need to spend more. Currently, uninduced demand (ie, demand with advertising stripped out) is outstripping the maximum supply that manufacturers can currently provide.

Which in turn suggests that manufacturers have seriously misplanned and misjudged their consumers, and that the drop in advertising spend is simply a symptom of this misjudgement.

Individual makes and models of car are ‘supply inelastic’, in that in the short term it is costly for a manufacturer to ramp up production: once an assembly line is at capacity, you have to build a new factory to increase numbers. This ‘inelasticity’ results in long waiting times for a car - and this is what we are seeing in the UK. Indeed, Volkswagen has stopped taking UK EV orders - it simply cannot fulfil them in a reasonable timeframe.

So, successfully advertising EVs would add to their current problems - a short-term view, but an understandable one, although - as I noted above - inimical to the companies' long-term interests.

The other argument is more sinister: could advertising spend be so low because the car industry simply doesn’t want to push us toward buying EVs?

There are only 19 models of 100% battery vehicle and 25 plug-in hybrid vehicles on the market compared to 417 petrol and diesel models. This difference in numbers is to be expected at this stage of the transition; but it is worth remembering that all 417 combustion models are all, currently, a) profitable, and b) doomed in a low-carbon future. Are the manufacturers simply engaged in a short-term ploy of trying to ‘eek out’ every penny of profit from their existing set of products?

If this is the case, then you could level the charge against manufacturers that they are deliberately slowing the low-carbon transition. This charge is reinforced by recent evidence that carmakers are manipulating emissions standards (again). And by evidence that car dealerships are actively pushing customers towards combustion vehicles.

Since there are a number of large manufacturers, each pursuing a different technological and marketing strategy, there almost certainly is not one single reason why advertising spend has changed in the way that it has. Nevertheless, the drop in spend from the industry as a whole would certainly suggest that manufacturers are not particularly trying hard to drive us to an electric destination.

Which in turn would be extending Britons' long and unhappy relationship with dirty air and city noise, and delaying a key ingredient in the smart flexible electricity system with its added roster of consumer benefits.

The DNA of our collective fleet is changing, but not as quickly as it could.

Share