What’s next for Old King Coal?

The time is nearly up for coal power in the UK, so how can we best use the sites left behind?

By Jonny Marshall

Share

Last updated:

Another week, another energy record in the UK. This time it’s the number of days that the UK was powered without burning any coal – a 55 hour spell broken just days later with a 72-hour stint. Earlier this year it was a full sweep of new records in wind output – record highs for half-hourly, daily, weekly and monthly generation – and we surely can’t be far off another solar peak and corresponding minimum transmission system demand.

While grabbing the headlines, these records can mask what is really going on underneath. All the talk of coal plants not running may suggest that they are in financial peril, that plants will close earlier than planned, and that capacity market contracts for years in the future may be at risk of being reneged on.

But – unfortunately for those hastening their downfall – coal plants have been onto a bit of a winner so far this year, despite pumping out just 8 TWh of electricity in the first three months of the year (just one-third of their maximum output). This would have been bad news for accountants at RWE, Drax and the rest of the gang, had it not been for the effects of the ‘Beast from the East’ coinciding with gas supply issues, sending the cost of natural gas through the roof and thereby making coal-fired generation more attractive.

Revenue boost

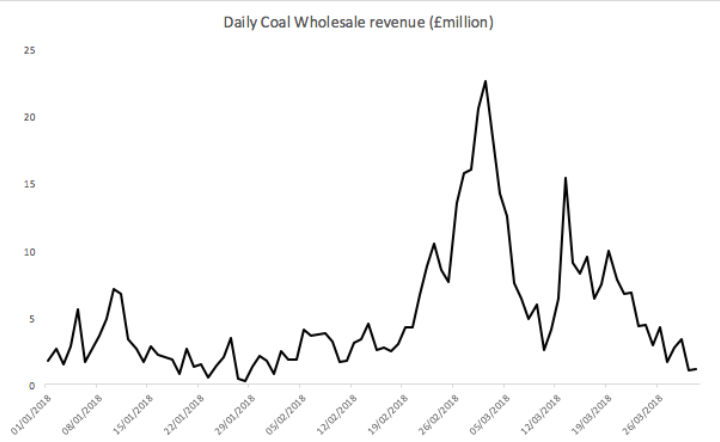

By lighting a rocket under the wholesale market, the early-March cold snap pushed up quarterly coal plant spot revenue to more than £460 million[i], less than £20 million short of that from two years ago, when the amount of electricity generated from coal was more than two-thirds higher. Add on the revenue from the capacity market, and there is barely any difference at all.

So what does this tell us? Mainly, that the UK coal fleet struck lucky this year. Nearly 30% of quarterly revenue came in just eight days. Without the cold winds from the East, owners would have been looking at accounts covered in red ink. However, while there is certainly a market in capturing peak prices, relying on once-in-a-decade storms is unlikely to impress investors.

Phase out looms

Altough the sense of dread accompanying the release of the annual accounts may have been eased for now, there is no questioning the fate of the UK’s coal fleet. The 2025 phase-out is set in stone, and on current pace, the frequency of plant closure announcements means we may only have one or two still running by then.

As we leave the coal age behind, what to do with the land the plants occupied will pose an intriguing question. There are frequently touted proposals from within the industry to make the most of existing grid connections and replace coal power stations with gas units, but these schemes don’t align with either existent carbon targets – which expect just 15% of electricity to be from gas in 2030 – or with tighter goals that are expected to appear later in 2018. As the concept of a national net-zero emissions target draws nearer, the power sector is likely to have to take on some heavy lifting for sectors that are harder to decarbonise, which doesn’t leave much room for gas power stations.

Landed

The availability of thousands of hectares of brownfield sites left behind as coal plants close is already attracting the attention of interest from outside the energy sector. Cockenzie in Scotland is being eyed for a new cruise ship terminal, Ironbridge in Shropshire for housing, Essex’s Tilbury port could be expanded to cover some of the footprint of the old power station, while others could end up as logistics centres.

Were these projects given the green light, some of the largest and best located connections into the UK power system could be lost. This risk coincides with National Grid showing concerns of how to keep the high voltage network balanced properly during the summer, as capacity becomes increasingly located on the distribution networks.

Another record that is broken so frequently it is no longer news is the falling cost of electrical storage capacity. Batteries can not only smooth out high and low demand periods, but can also provide essential services to the grid, such as frequency response and synthetic inertia – just the ticket for National Grid’s concerns on keeping the system ticking over. Repurposing these sites to incentivise storage capacity that would pump electrons into the heart of the UK grid would be a boon to those tasked with keeping the system running.

Some developers have talked about co-locating batteries with gas power stations, including a recent announcement for the redevelopment of Tilbury. But as it stands, there isn’t a great deal of interest in building standalone batteries on scale.

A previous blog outlined the potential for big changes in UK energy policy following a five-year review of the EMR, and there is nothing to stop ministers and civil servants writing new rules to boost the viability of battery storage in the UK: accurately de-rating projects for capacity auctions, allowing the full range of revenue stacking, and offering tax breaks to projects that can deliver on a grid-scale rather than burdening projects of a certain size with extra red tape.

The government has already stated its desire to be at the forefront of the storage industry, and reforms like this could play a major role in replacing the energy infrastructure of the past with that of the future.

Share