How to cut the UK’s dependency on Russian gas… permanently

By Dr Simon Cran-McGreehin

@SimonCMcGShare

Last updated:

The tragic events unfolding in Ukraine, and the UK and Europe’s current dependence on Russian gas, are focussing attention on the need to get off gas as a national security priority.

Were it not for the dependence on gas, stronger sanctions could be being placed on Russia. Given the interconnected nature of the global gas market (less so for the US which is not connected by pipelines and has limited LNG terminal capacity), the UK gas price has closely tracked the European gas price which has leapt since the Russian invasion of Ukraine.

Many households in the UK will find it increasingly difficult to cover their rising energy bills. The invasion wiped out the small fall in gas prices that had occurred this year, and dashed any hopes of returning to some sort of ‘normality’ any time soon.

Drastic action

With Europe determined to end its use of Russian gas – if Putin doesn’t cut off supplies first – previously unthinkable options are now in play.

Germany’s Green Party, so recently in power as part of the new coalition Government, is considering over-turning decades of opposition to nuclear power in help order to disarm Putin’s gas trap.

Leaders around the world are considering an emergency supply of non-Russian gas for Europe, over-riding years of liberalised markets. The US could use legal powers to direct LNG shipments and leverage over Middle Eastern producers, and the UK could offer its LNG facilities as a gateway to supply Europe via our extensive interconnection and could also try to muster a little more gas from the North Sea.

And with the UK at risk of paying £2.3billion a year for Russian gas (the equivalent of £6.3million a day), there are calls to cut out those imports which account for 4% of our gas demand.[1] Gas companies already taking a hit and cancelling contracts for Russian gas, and shipments are being turned away. In the very short-term the UK should look to find gas supplies from elsewhere in the world, but this is only an (expensive) stop-gap measure.

Common sense solutions at risk of being overlooked

Alongside the dramatic interventions being considered, the UK can take simple steps that will have a major impact in reducing our exposure to the volatile price of gas – from whatever source.

As ever, the simplest solution is to use less gas – through better energy efficiency such as insulation, and through moving away from gas altogether for example by switching to heat pumps for homes and renewables for power generation. But whilst these solutions are tried and tested, they have been persistently under-used in the UK, leaving us overly exposed to gas price rises.

But with the gas crisis in overdrive and showing no signs of stopping, and with clear risks of similar crises occurring in the future, the UK must focus on solutions that will permanently protect our national security and shield households from unaffordable energy costs.

Indeed, if the UK was able to nobly provide some extra North Sea gas to help Europe as suggested by the International Energy Agency in its Ten Point Plan, that would hasten the decline of our limited remaining resources. That’s not a reason to withhold help from Europe – rather, it further reinforces the logic of reducing demand now to avoid us getting into yet more import-dependence in future. As we’ve seen, gas produced in the UK doesn’t come cheaper when the wider market price is high.

Options for cutting gas demand and imports

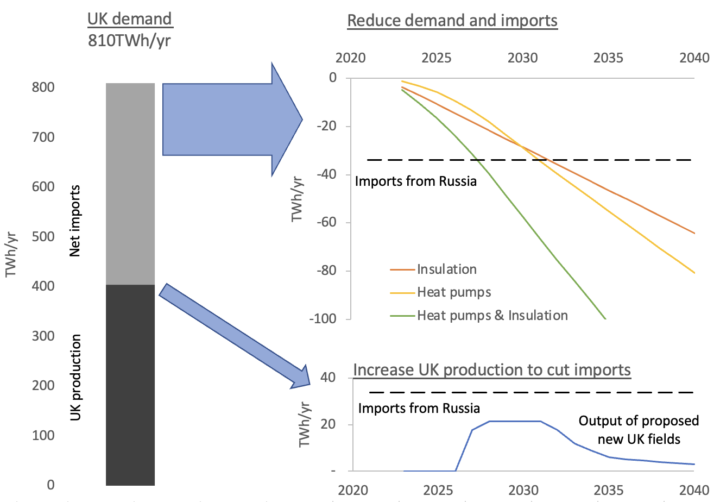

The following chart illustrates a set of scenarios of how home insulation and heat pumps could reduce UK gas demand and hence imports, compared to the impact of proposed UK gas production.

These scenarios are discussed below; but first, some context. [2]

- UK gas demand was around 810TWh in 2019. Of that total UK demand, about 310TWh per year (38%) was for homes.

- At the recent average price of about 200p/therm (£68/MWh), 1TWh of gas costs £68million.

- The horizontal dashed lines mark the 33.7TWh of LNG imported from Russia in 2021 (about 4% of UK demand, and equivalent to £2.3bn/yr at current prices) – a major target for current ambitions.

Note that 2019 data was used for most of this analysis because it was unaffected by the pandemic and so can be assumed to be more representative of life in 2022, and because 2019 is the latest year of comprehensive data for energy demand by EPC ratings.

North Sea drilling

Let’s first look at the proposed expansion of North Sea drilling – that’s the humped line on the chart.

This was proposed earlier in the year as a flawed attempt to cut prices – flawed in that any extra gas would still be priced in the same way, with no way of stopping it leaving the UK. But with the invasion looming, it was being considered as a way of diversifying gas supplies for the UK and Europe – this is more plausible than affecting the price, but would be of limited impact in reality.

Of the six fields rumoured to be under consideration, three would produce gas – their impact would be limited in three respects: [3]

- Not immediate: They wouldn’t start operating until about 2026, or reach peak output until 2028, and so can’t help with the immediate crisis.

- Small impact: Their maximum output of about 21TWh per year by 2028 would be about 2.4% of UK demand, and just over half the level of imports from Russia.

- Short-lived: From the early 2030s, their output would decline.

It’s possible that drilling could be expanded elsewhere in UK waters to change the timescales and/or output, but this current round of proposals illustrates the limited potential impact.

Insulation

The insulation scenario is described in this previous ECIU analysis. Essentially, it envisages upgrading 1million homes each year from the current average EPC rating of band D to the Government’s ambition of band C – this gives an average cut in gas demand of 20% per home. [4]

Back in 2012, the UK installed 2.3million insulation measures (mostly loft and wall), but then policy changes slashed uptake and the rate has since averaged 10% of that level peak. By returning to those demonstrably achievable levels, 1million homes a year could receive two major insulation measures, as the core part of a package supplemented by other measures (e.g. draught exclusion, new heating controls, etc) tailored to give a 20% cut in gas for each type of home.

A 20% cut across 1million homes is 3.6TWh per year: that’s 1.15% of household gas use; 0.44% of total UK demand; and 0.69% of UK net imports. It would be worth at least £245million per year under current wholesale prices.

If this insulation scenario was pursued immediately, the first million homes would save that 3.6TWh every year from 2023 onwards, joined by the second million homes from 2024, and so on. The annual savings would already be at around 18TWh by 2027 for 5million homes upgraded by that point, matching the output of proposed new gas fields. Plus, the annual savings from insulation would carry on growing as more homes were upgraded, overtaking extra gas production.

And whereas the production of gas fields is finite and tails off, the savings from insulation are received every year and are permanent. The cumulative savings across the years soon become enormous – within 12years, we’d have saved the equivalent of a year’s worth of current housing gas demand.

Some experts think that the UK could go even faster on insulation than we did in 2012, pointing to the fact that installation rates were on a rising trend before they were slashed by the change in policies.

A scenario developed by the Committee on Climate Change (CCC) found that major improvements across the UK’s housing stock would cost no more than £1,000 for around two-thirds of homes. Whilst that scenario isn’t exactly the same as ours, it illustrates that millions of homes are fairly easy to upgrade – it would quite possible to find 5million homes that could cheaply achieve 20% cuts in gas demand before 2027.

With gas prices expected to remain high for at least a year, a band C home would spend at least £170 a year less on gas than a band D home, giving payback on insulation in just a few years for some homes – and faster still if the crisis is even longer and deeper, as looks likely.

Heat pumps

Heat pumps for heating and hot water remove end-use gas consumption entirely, and will be £260 a year cheaper to run than gas boilers under the April price cap. These cost savings are due to heat pumps’ high efficiency and their use of electricity that is increasingly generated by cheap North Sea offshore wind farms.

This scenario assumes the Government achieves its aim of reaching 600,000 heat pump installations per year by 2028, up from about 67,000 in 2021 – we’ve used a linear trajectory between those two points, and assumed 600,000 per year thereafter, which would probably be an underestimate. [5]

The scenario assumes that heat pumps are first of all installed in homes with an EPC rating of band C – the ‘low-hanging fruit’. These include many newer homes, and their lower heat demand means they are the most ready for a heat pump without any additional insulation.

Our model suggests that an average band C home would see an 80% cut in gas use at present – it’s not 100% because the current grid mix includes about 40% gas-powered generation, which is included by factoring in the efficiencies of gas power stations, gas boilers and heat pumps. For future years, we’ve factored in a decline in gas use for electricity generation (down to about 30% by 2030, some of that using CCS to capture emissions) as more cheap renewables come online. As a result, the gas savings grow each year, exceeding 85% per home by 2030.

As with the insulation scenarios, the savings in each year found by multiplying the savings per home in that year by the number of heat pumps installed up to and including the previous year.

Based on our trajectory to the Government’s planned deployment target, 1.5million heat pumps could be installed before 2027, giving gas savings of 17TWh per year just at the point when proposed gas fields would be starting production.

The savings from heat pumps would rapidly overtake the extra gas output as more heat pumps were installed – probably even faster than in our scenario as rates would presumably carry on growing beyond the target of 600,000 per year. Plus, the savings from heat pumps would be permanent, and would increase with renewables increasingly power the electricity grid.

Furthermore, it would be possible to install heat pumps in over 6million band C homes by 2031-32, saving the equivalent of current imports from Russia – at the point when proposed gas production would be starting to tail off.

Combining the two…

The UK is already committed to rolling out insulation and heat pumps together, and even by sticking to current heat pump installation plans and taking insulation rates back to previous levels, the UK could rapidly shift away from gas. Heat pumps and insulation often go well together as a package for homes, or they could be targeted separately – our simple model assumes heat pumps are used in band C homes (with a decent level of insulation already), and insulation in homes rated band D or worse (to bring them to band C, providing a steady supply of homes for heat pumps in our model).

The upshot is that using both approaches together gives very rapid progress. The UK could reduce gas demand by the equivalent of its imports from Russia by as early as 2027. In just over 10 years’ time, gas savings would reach 80TWh per year, which is over 25% of current household gas demand and about 10% of total UK demand.

The savings would grow as more homes were upgraded and more heat pumps were installed. And the cumulative savings would grow dramatically, saving a year’s worth of housing gas demand over just nine years.

Summary

Amidst the shock of this war and the rush to develop radical solutions to the crisis facing gas supplies, the UK would do well to look to practical measures it can take that will permanently reduce bills particularly for those who are increasingly struggling to cover them.

More UK gas will not cut energy bills.

More insulation and heat pumps will cut bills, but are now also a matter of national security. They can be installed to start cutting demand and imports right away and a concerted deployment campaign would see those savings build into a major contribution to ending our gas dependency, cutting Putin’s power and the vulnerability of our poorest households to the volatile gas market.

Endnotes

[1] This estimate assumes that UK imports of Russian gas are the same as in 2021 (33.7TWh) and that the wholesale price is the approximate average from the past few months (200p/therm), giving an annual cost of £2.3billion.

UK gas demand is around 810TWh per year (excluding losses and energy industry usage) – for example, see data for 2019 and 2020 in DUKES Chapter 4 (BEIS, 2020), and DUKES Chapter 4 (BEIS, 2021). With similar levels in 2021, imports from Russia of 33.7TWh accounted for just over 4% of demand – source: Energy Trends, BEIS (February 2022), files ET 4.1 and ET 4.4.

[2] In addition to the points noted in the main text, the following nuances can be relevant:

- UK total gas use in 2019 was 878.0TWh, of which 67.5TWh was ‘losses and energy industry use’, leaving 810TWh of gas demand (values do not sum perfectly in the Government data).

- UK production was 439.0TWh.

- UK imports were 518.1TWh and exports were 87.7TWh, giving net imports of 430.4TWh.

It’s not straightforward to unpick how much of the exports were from UK production and how much were from LNG imports that were essentially transiting through the UK to other countries via interconnectors. But on a simple level, we can say that total UK gas use of 878.0TWh was met by an almost exactly 50:50 split between UK production and net imports. So, this analysis used gas demand of 810TWh/yr met by a 50:50 split between UK production and net imports.

[3] Analysis by ECIU and Uplift, using data by Rystad Energy.

[4] See: Insulation and gas prices, ECIU (2022)

[5] This analysis assumes average efficiencies as follows: gas boilers 85%, heat pumps 300%, gas power stations 60%. It uses average gas consumption of 10,600kWh/yr for EPC band C homes, such that: heat demand is 9,000kWh/yr, electricity demand from the heat pump would be 3,000kWh/yr, of which gas power stations would currently provide 40% (1,200kWh/yr, but falling to 30% by 2030 as an illustrative change), requiring 2,000kWh/yr of gas (19% of average band C gas demand, but falling to 14% by 2030).