Net zero: power

How can the UK power itself in a net-zero world?

By Dr Simon Cran-McGreehin

@SimonCMcGShare

Last updated:

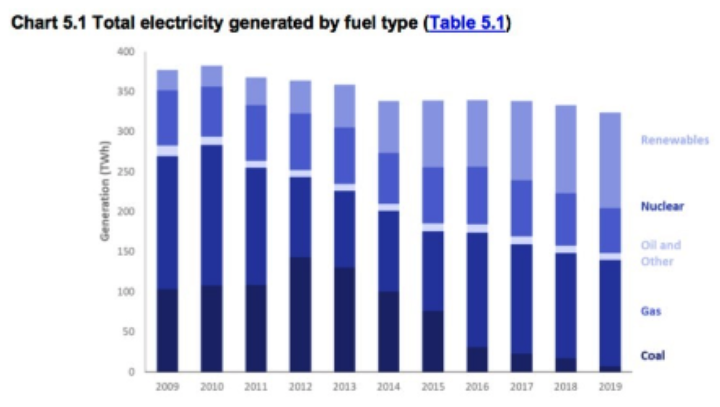

Since 1990, the carbon dioxide produced by UK power stations has fallen by 63%, declining by 8.4% from 2018 to 2019 alone. This precipitous fall has been driven by two policies – the carbon price floor, which increases the cost of generating electricity from coal, thereby favouring the burning of gas; and support for renewable energy in the forms of feed-in-tariffs, renewable obligation certificates and contracts for difference. Falling demand has also contributed to power sector decarbonisation.

Electricity accounts for a quarter of domestic energy use. Noting that the coronavirus pandemic caused electricity demand to fall, generation from renewables surpassed that from fossil fuels for the first time in 2020; 43% was from renewables, 36% of electricity was generated from burning gas (38% from all fossil fuels) and 16% from nuclear power.

Since 2015, coal use for power generation has plummeted, generating just 2% of electricity in 2020 with gas and renewables making up the majority of the fall. Britain plans to phase out coal by 2024 and has had a coal free system for over two months during summer 2020.

Burning natural gas is cleaner than coal, but it is not a low-carbon fuel. Reliance on natural gas also leaves the UK vulnerable to supply shocks and rising import dependence.

The amount of electricity needed to power the UK is also decreasing as homes, domestic products and industrial processes become more efficient. From 2008 levels, electricity demand fell by around 12% to around 300TWh in 2018, but is expected to rise in 2021 to 325TWh. This trend, however, is expected to reverse in the future as electricity is used in new applications, such as transport and heating.

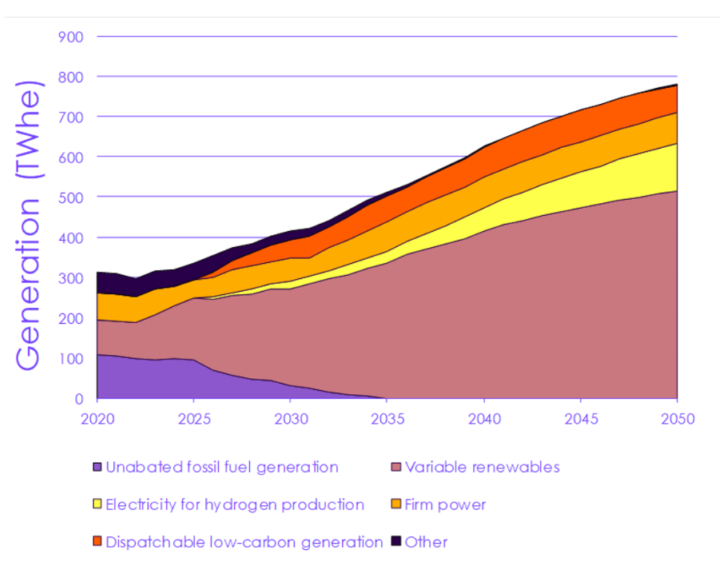

An expected increase in demand for electricity means that a net zero power sector needs to replace existing carbon-intensive power stations with low-carbon alternatives, as well as increasing overall system capacity.

The Climate Change Committee estimates that electricity demand could reach 500TWh by 2035, and double or triple from current levels by 2050. It estimates that variable renewables could meet the majority of increased demand over the next 15 years, replacing coal power stations, which will all be offline by 2024, and gas generation.

By 2030, just one of the UK’s nuclear power stations currently in use will still be in operation. The fleet of new projects intended to replace the fleet has struggled with delays, with just one project currently under construction at Hinkley Point in Somerset. Small modular reactors, supported by the industry, are yet to materialise.

Similarly, hydrogen could be a significant source of firm clean power in the future, filling in when wind and solar output dips. However, current hydrogen manufacturing techniques (reformation of natural gas) are not net zero-compatible, and would need to be replaced by electrolysis using green electricity.

Over the last decade, costs of offshore wind electricity have fallen by around two-thirds, from £150/MWh to under £50/MWh. The dramatic falls in the cost of wind and solar capacity will likely see the vast majority of current gas capacity replaced by turbines and panels. A more flexible electricity system is needed to accommodate the variable supply from technologies driven by the weather.

This generally involves utilising four ‘flexibility mechanisms’:

- Interconnectors that allow the UK’s power grid to export renewable energy or import it from a much larger geographic area

- Demand side management, incentivising the shift of non-essential industrial and household processes to times when electricity supply is abundant

- Increasing storage of electricity (for example in batteries or pumped hydro facilities), allowing it to be ‘banked’ when generated but not needed, then released when demand rises. Batteries of electric vehicles plugged in with ‘smart’ chargers could provide a nationwide ‘distributed battery’

- Boosting the number of small gas ‘peaking’ plants, which are able to respond rapidly to fluctuations in demand

To update the existing ‘Smart systems and flexibility plan’ published in 2017, the Energy White Paper commits to a new Plan in 2021 that will detail the progress made and work needed to manage an electricity system largely based on renewables and manage electric vehicle infrastructure, like charging. The UK has also taken a lead in a number of these areas, pioneering new techniques to aggregate and manage storage, and cutting-edge technology firms that allow people more visibility (and therefore control) over their energy demand.

The benefits of moving to a smarter energy system are vast, estimated at up to £8 billion per year by 2030 by the National Infrastructure Commission, or £17-40 billion by 2050 by researchers at Imperial College London.

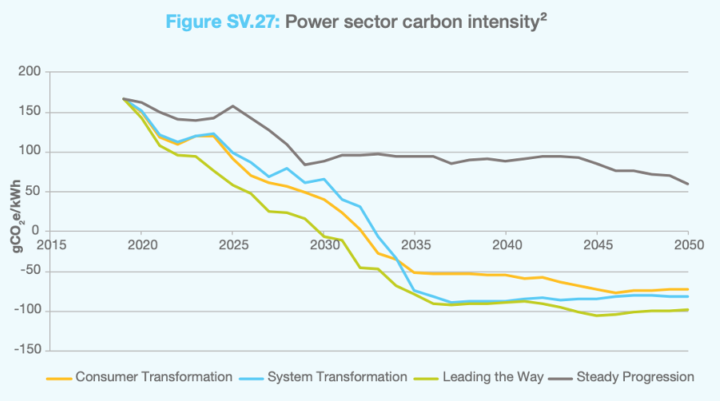

Forecasts

Predicting the exact shape of the electricity system in decades to come is a difficult and complicated task, and often fails to account for disruptive technologies that can upend the ‘normal’ order. That being said, National Grid’s most recent models of the future of the energy system sees carbon intensity for the power sector getting to below zero by the mid-2030s (down from around 200 g/kWh today); so extending all the way to zero emissions is not fanciful.

This is based on rapid expansion of renewable and nuclear capacity during the 2020s and widespread take up of electric vehicles. Taking this scenario all the way to zero emissions could be done by more investment in renewable energy and flexible technologies, or by the deployment of carbon capture and storage (CCS). The power sector could even become a net absorber of carbon dioxide if negative emission technologies are rolled out, which are likely to be needed sto reach net zero emissions across the economy.

The 2018 National Infrastructure Assessment found that a switch towards low-carbon and renewable sources for power and heating would see householders pay the same in real terms for their energy in 2050 as they do today. The Government’s response to this assessment is yet to be seen.

Some scenarios have been modelled that are based on 100% renewable energy, but the general consensus is that a mixture of low carbon technologies, including nuclear power, will be used to decarbonise the power sector.