The Net Zero-Trade Nexus: Opportunities and risks for the UK

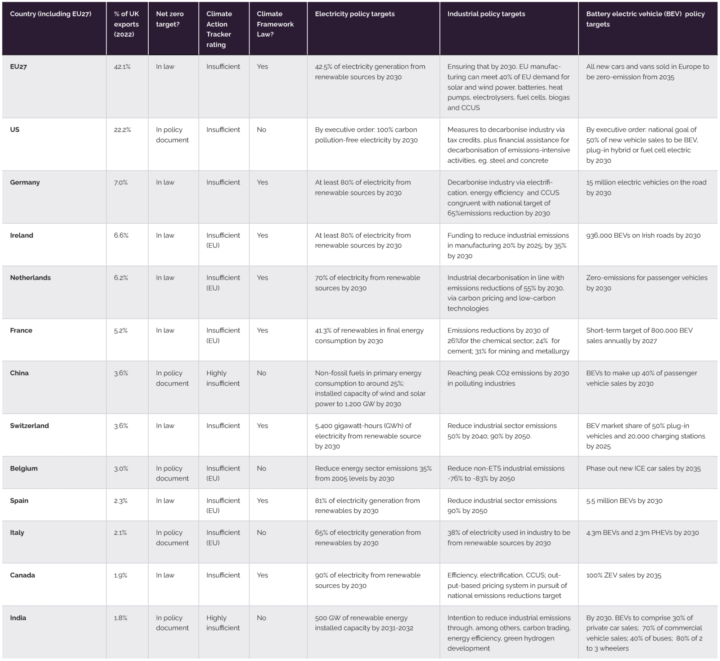

Assessing the net zero targets and policies of the UK's largest trading partners.

Last updated:

For the first time, UK exports have been analysed in the context of trading partners' net zero commitments. This includes whether their targets are legally binding and the proportion of companies in those countries aiming to achieve net zero across their full value chains (including scope 3).

Two-thirds of the world’s largest companies have committed to ending their contributions to climate change within the next few decades and the vast majority of the global economy has committed to reaching net zero emissions. The drive toward decarbonisation is transforming global supply chains and trade relationships, fuelled in part by the growing adoption of net zero-compatible policies, regulations, and international standards. Those countries that fail to make the transition at home risk losing their competitive edge in evolving export markets.

To examine how these changes could affect the UK, the world’s fourth largest exporter, we developed a unique dataset comparing 2023 UK trade data with details of national- and company-level net zero targets from the Net Zero Tracker.

The findings highlight several risks and opportunities associated with the UK’s largest trading relationships:

- The future is clean: 94% of the UK’s exports by value go to jurisdictions that have net zero targets. These exports, to 146 nations, are worth £796bn to the UK economy. 91% of UK exports by value go to jurisdictions that have net zero targets enshrined in law or outlined in official policy documents.

- 54% of UK exports go to the 26 trade partners (including the EU) that have enshrined net zero in law — the strongest level of climate commitment.

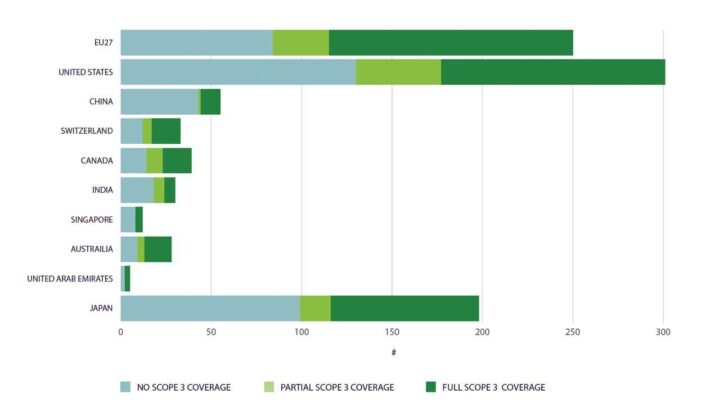

- Representing $13.3tn (£10.3tn) in annual revenues, 412 (of 951) companies headquartered in the UK’s 10 largest trading partners — the EU27, the US, China, Switzerland, Canada, India, Singapore, Australia, U.A.E., and Japan — aim to drive their full value chain emissions (including scope 3) to net zero by mid-century.

- Amid growing concerns about a potential squeeze on UK exports to the US under a protectionist Trump administration, Net Zero Tracker data shows notable climate ambition among US states. When weighted by GDP, half (49.6%) of US states have net zero targets. Additionally, two-thirds (66.2%) have either net zero or emission reduction targets of at least 80% by 2050. US firms with net zero commitments collectively generate over $10.2 trillion (£7.9tn) in annual revenues.

- 135 EU companies with net zero targets fully cover scope 3 (full value chain) emissions, 53 of which are headquartered in France and Germany.

- In the manufacturing sector, 53 (of 114) companies headquartered in the UK’s 10 largest export partners aim to drive their full value chain emissions (including scope 3) to net zero by mid-century, representing $1.7tn (£1.3tn) in annual revenues.

- These net zero and scope 3 commitments will reshape global trade dynamics and relationships. As the world’s fourth largest exporter, the UK’s economic success will depend on how it navigates these shifting dynamics and leverages its green comparative advantage across a range of low-carbon goods and services.

By decarbonising its own economy, reducing its own carbon footprint, and thereby lowering the carbon footprint of its products, the UK can position itself as a more attractive, lower-carbon supplier for companies committed to driving down their supply chain, or scope 3, emissions.

Despite being a services-oriented export economy, the UK possesses expertise across a diverse range of green manufacturing sectors. The British export mix of tomorrow will have to look radically different from those of today, as demand for high-carbon commodities is progressively constrained, and demand for low-carbon products rises.

- Analysis of export partner policy commitments point to growing export opportunities in the power sector,green steel, heat pump and electric vehicle industries as well as more nascent areas such as low-carbon fertiliser production and transition-as-a-service (TaaS).

Alongside exports, the UK seeks to attract foreign direct investment (FDI) to help grow its net zero industries. Its own array of policies and incentives, helping to stimulate its own domestic market, will determine how successful it is in this venture, as well as underpinning its future export potential.

The UK's ambitious new nationally determined contribution (NDC) aims to cut emissions by 81% by 2035, sending a strong signal to the world that it is ‘open for green business.’ By reaffirming its commitment to multilateral climate leadership and committing to fair, reciprocal trade relationships, the UK can strengthen this message.

While these trends may shift when US President-elect Donald Trump takes office in 2025, many individual states maintain independent climate policies. Furthermore, current clean energy legislation is fostering job growth — especially in Republican-leaning states — making it politically difficult to dismantle such measures.