Project Blackout Fear: Winter hype or reality?

With National Grid's first look at the coming winter due, we take a look how the UK grid keeps ticking over

By Jonny Marshall

Share

Last updated:

Just as the first cuckoo heralds the arrival of spring, National Grid's assessment of the supply-demand gap for the coming winter tends to presage a blooming of ‘Blackout Britain’ headlines. Although come to think of it, this time they might count as light relief, given the current state of political and economic news.

Anyway, Grid is due to publish this year's initial assessment shortly. As it does so, here's our cut-out-and-keep guide to numbers, hidden truths and trends, helping you - we hope - to cut through some of the hype and hysteria.

The UK’s energy system is in transition, following the path of other industrialised nations to a flexible grid with renewables at its heart. Demand is falling as energy efficiency improves, while ageing, inefficient coal-fired power stations are closing. The transition has been in train for at least a decade, and so have warnings that the lights were about to go out.

But still 'Project Blackout Fear' has failed to burst into darkness, with more than sufficient measures in place even as renewables provide a quarter of our electricity, evidenced by the lack of a generation-driven outage in more than a decade.

This Winter

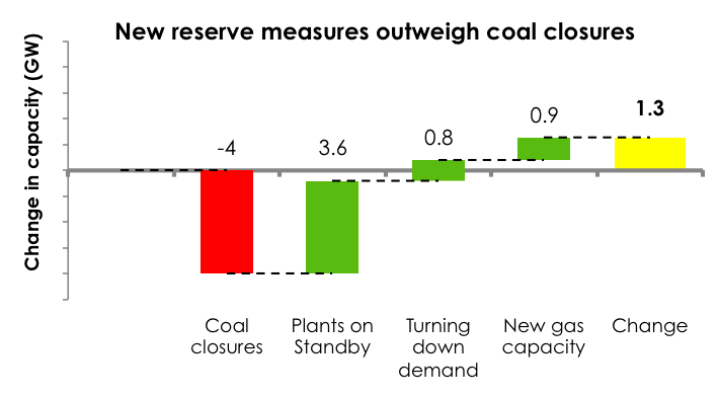

Coal power stations with capacity totalling around 4 gigawatts (GW) have closed this year, as low wholesale prices and ever-increasing maintenance bills made them less economically viable. Longannet, Ferrybridge and Rugely have shut down, while other coal capacity at Eggborough and Fiddler’s Ferry has been moved into reserve, whereby they are kept on standby should a power station fail or wind levels fall at a time of high demand.

In fact, 12 power stations have signed up for the winter reserve (dubbed the Supplemental Balancing Reserve, or SBR), capable of providing 3.6 GW of power into the grid. For comparison, this is close to 7% of the highest peak demand recorded last winter, and more than the capacity of the controversial proposed Hinkley Point C nuclear power plant.

In addition to a supply backup, National Grid has contracts with businesses that agree to turn down non-essential processes (air conditioning, refrigeration, pumps etc) should margins become tighter than they would like. An auction held in January secured 475 MW of capacity that can be turned down (as well as more than 300 MW of small fossil fuel capacity), while a tender for further demand-side balancing has been issued.

On top of this, the 880 MW gas plant in Carrington, Greater Manchester is set to come online before the end of the year.

Therefore, for this winter alone, reserve measures and new capacity outweigh the coal plants closing, by more than 1 GW (Figure 1). These figures do not include growth in renewable capacity, which increased by 3.3 GW over the past year; nor does it account for the continuing downward trend in peak demand over recent years.

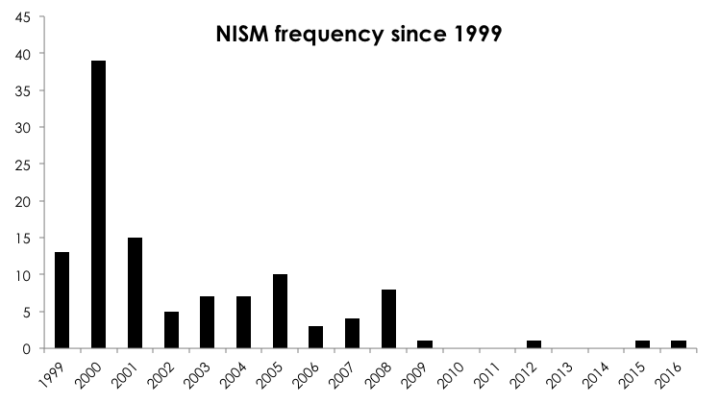

Other tools at Grid’s disposal include issuing a request for power from uncommitted capacity, commonly known as a Notice of Insufficient Supply Margin (NISM). Often picked up by the press as a sign of impending doom, a NISM is used to alert owners of plants and storage facilities that there may be an increased need for power. It invites offers to turn up generation or reduce demand to increase the 'safety cushion' within the grid.

As more variable wind and solar installations are connected to the system, it is likely that the frequency of NISMs will increase, although they are currently at a historic low. Just two NISMs have been issued in the past 12 months, a far cry from the 39 issued during the year 2000 (Figure 2).

The list of tools available goes on. National Grid is able to boost imports into the UK from interconnectors (undersea cables to France, the Netherlands and Ireland have a capacity of 4 GW, with a further 2 GW of connection to France and Belgium expected in 2019).

For short-term fluctuations, such as sudden plant outages, the UK has around 3 GW of pumped hydro storage that begin generating within seconds. It can also call on ‘spinning reserve’, power plants that are operating but not feeding into the grid. If margins are tight, the grid can also be operated at slightly lower voltage than usual, a process generally unnoticed by consumers.

Winter 2017 onwards

With the arrival of the capacity market next winter, the cushion between supply and demand is set to grow.

The capacity market is a medium-term solution to ensure that sufficient amount of turn-on-when-needed capacity (coal, gas and nuclear plants, with a small element possible for interconnectors and demand-side measures) are available to meet peak winter demand. Plant owners bid into an auction that rewards them for maintaining availability throughout the winter, rather than risking the stations closing down if profitability wanes. Existing short-term measures such as the SBR are expected to close once the capacity market is operating.

The government carried out an auction in 2014 to secure capacity for winter 2018/19; however, there will be another 'top-up' auction later this year to procure capacity for next winter. Auctions to date have cleared at prices well below market expectations, highlighting the fact that there is capacity available, and providing better than expected value to customers.

Further ahead, close to 1 GW of new offshore wind is expected to be up and running by next winter, with more than 4 GW in the pipeline for 2020. This is additional to capacity that will be secured in the next Contracts for Difference (CfD) auction, which will take place by the end of the year and boost offshore wind growth. Two more auctions will take place by 2020.

Demand-side Response

While National Grid has a healthy number of options in place to keep power flowing into UK homes and businesses, it is mainly focussed on the supply side. That is, means of balancing the electricity grid arise from changing the output of power stations, rather than by implementing the potential for reducing demand.

Demand side response (DSR) has the same effect on the grid as increasing generation (in addition to reducing strain on the system) yet is far cheaper to implement than building new capacity. DSR can be achieved for around £200,000 per MW, compared to around £700,000 per MW of new gas capacity.

In its latest Future Energy Scenarios report, National Grid forecasts between 0.8 and 5.7 GW of DSR available by 2025. However, at least one provider believes that at least 3 GW of DSR is available now, enough to knock £1 billion off UK bills, with market structure being the key constraint. Looking further ahead, a report by Sustainability First identified a possible 18 GW of DSR, equivalent to one-third of peak UK demand.

However, without the access to markets enjoyed by new and existing power plants, DSR is struggling to realise its potential. Considering the time taken and uncertainty involved in building new power stations such as Hinkley and Trafford, DSR represents a quick, cheap and green way of increasing margins between supply and demand within a few years.

Demand side response is a vital component of the ‘smart grid’ proposed by the National Infrastructure Commission, capable of saving the UK £8 billion per year.

As I mentioned above, the UK's power system is in the middle of a transition to a more flexible model, as called for by EnergyUK and the National Infrastructure Commission, among others.

It is gaining prevalence in forecasts by the National Grid and was identified as a means of increasing security by Energy Minister (and contender to be Britain's next Prime Minister) Andrea Leadsom earlier this week, when she told the Utility Week conference that by 2040, we could see Britain equipped with 15-23 GW of storage, and similar amounts of interconnection and demand-side response.

That's a lot of flexible capacity with which to balance out those periods when the wind doesn't blow and the sun doesn't shine. But we're not there yet - and in the meantime, there's fair bit of make-do-and-mending to be done using tools such as SBR. It comes at a price - but so far it's been keeping the lights on, and there's no reason so far to believe that this winter will be any different.

Share