How much truth is there in Trump's coal renaissance?

The US president claims to be reinvigorating the coal industry, do his claims hold any water?

By Jonny Marshall

Share

Last updated:

President Trump's speech detailing the US ‘withdrawal’ from the Paris agreement on climate change left us in no doubt of his love for both coal miners and the sector in general. And amid the many obfuscations and irregularities there were some startling claims surrounding the coal industry that merit closer attention.

One was the opening of a new coal mine - although he didn't name it, it's the Acosta Coal Mine in western Pennsylvania - this month, which he said would be the first of many.

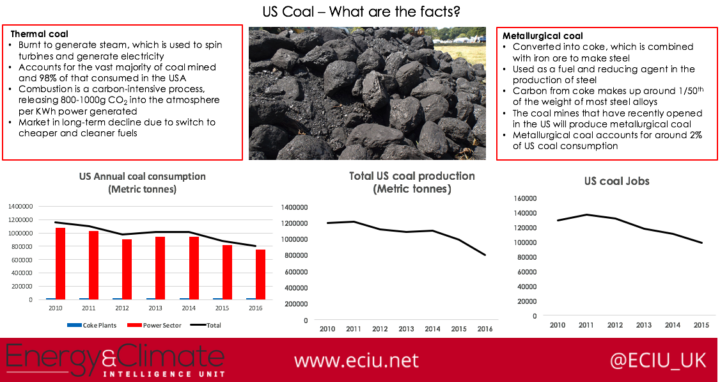

Is it big deal? Well, Acosta will only employ 70 people and will stand almost alone against the tidal wave of mine and power station closures spreading across the US (and the vast majority of the developed world). Recent years have seen a succession of coal mines idled or shut down, many in Trump-supporting heartlands; annual coal production has dropped by more than 400 million tonnes, upwards of 35%, and the number of people employed in the sector is down nearly a quarter since just 2010.

Questions have also been asked over Scott Pruitt’s dubious claims that 50,000 coal jobs have been created under the Trump presidency. This figure actually refers to the total number of mining employees in the sector.

In fact, so far, given that the Acosta mine decision was taken under President Barack Obama, it's unclear that Mr Trump's administration has so far created a single new coal job.

'Wrong type of coal'

Despite these inconvenient truths, the new mine has been championed within certain echo-chambers as the beginning of the end of top-down supranational regulation, and touted as a means of ‘making America great again’ by the most powerful man on the planet.

And indeed, Acosta isn't the only one. At least three other mines are slated to open in coming months, with other mining companies and other investors reportedly seeing new business opportunities.

But before we all get carried away with the coal revival, it's vital to consider the type of coal being mined and how it will be used. Instead of finding itself on a train towards a power station, and ultimately as carbon dioxide in the atmosphere, the mine will produce metallurgical coal, used to make steel. Rather than combusted to generate electricity, metallurgical coal is ‘coked’ – heated to around 1000oC in an oxygen-free atmosphere – before being combined with iron ore in a blast furnace to produce steel.

This is a far smaller deal for the coal industry - metallurgical coal makes up a tiny fraction of both US and global output compared with thermal coal, the type that is burned in power stations. And try as he may, The Donald cannot take credit for the recent upturn in metallurgical coal prices, boosted by Chinese production curbs, which rendered the Acosta mine profitable (at least in the short term).

Last year, the US consumed around 16 million short tons of metallurgical coal, compared with more than 670 million short tons of coal in the electric power sector - metallurgical coal accounting for a mere 2% of overall consumption.

The big rub in the President's announcement is that as well as Acosta, all the other new mines announced so far are also for metallurgical coal. And before anyone other than the President and Mr Pruitt see this as a route back to mass employment, consider the words of Pennsylvania-based Corsa Coal Corp Chief Executive Officer George Dethlefsen: 'We’re staffing up - we're going to hire 100 people."

A hundred? Altogether, mines in Pennsylvania employed 6,633 people in 2015 [pdf] - so the new mine represents a workforce expansion of just 1.5%. In 2014, the Pennsylvania total was 7,938 - so the state lost 13 times as many jobs in the course of a single year as are being created now.

Trending downwards

In US power stations, consumption of thermal coal is falling rapidly - more than 30% lower in 2016 than just six years prior. These figures (and the graph below) show the extent to which the industry is in decline. Clearly a few new mines producing boutique metallurgical coal cannot make up for this trend.

What's less well known is that despite these mine openings, demand for metallurgical coal has also fallen - down more than 20% since 2010. Which is largely tied up with the decline in the US steel industry.

Producing one tonne of steel requires around 770 kg of coking coal, with the majority of carbon therein trapped inside the metal. Therefore, Mr Trump’s new mine – with an expected output of five million tonnes of coal over twelve years – will allow around 320,000 tonnes of steel to be produced each year. For reference, over the past year the US produced more than 33 million tonnes of steel, while importing another 8 million tonnes from overseas in March 2017 alone.

The US steel sector is facing similar pressures to that in the UK: chronic global oversupply, sliding demand for virgin steel – 86% of steel produced in the USA is recycled – and an uncompetitive labour market due to higher wage demands that workers in developed nations command. Recycled steel, produced in electric arc furnaces, needs no coal - and is increasingly set to dominate global production. As such, the long-term future of primary coal production in the US is surely limited.

Coal comfort

Back to thermal coal, and to Mr Trump’s promise to revive the industry.

Following the explosion in US oil and gas production, coal power plants have found themselves pushed toward the margins. Priced out by lower cost gas and renewables, coal power stations are increasingly announcing closures, with recent analysis showing that despite the rhetoric, the structural shift away from coal remains very much underway in Trump’s America.

The scale of this shift is evident in the data, with 2016 the first year in which coal was knocked off the top spot among electricity generation sources. With more than 90% of US-mined coal flowing to power plants, which are coming under further pressure from growing renewable and gas-fired capacity, the coal power industry and hence mining would appear to be on a one-way track to extinction.

Far from being unique to the States, this trend is also seen across Europe. Coal plants are struggling to make money, with many only remaining online only due to taxpayer-funded capacity payments. A sizeable number of European plants are also set to fall foul of new pollution regulations, passed by a whisker in the European Parliament, with the aim of ensuring more air across Europe is safe to breathe.

Countless people and organisations have warned that Mr Trump will be unable to resurrect the coal industry. Despite this, some Brits with a similar view of the world have suggested that the UK should follow his lead: scrapping climate legislation, despite overwhelming public support for its retention, and undoing world-leading progress on the move away from coal power. Apart from other considerations, this would be a direct contradiction of the Conservative manifesto promise to remain at the ‘forefront of action against climate change’.

In the last couple of weeks alone China and India have reconfirmed their support of the Paris deal, with the former eyeing a leadership role in the clean energy transition, and the latter pledging to ‘go beyond’ previous commitments. In the most recent of a dizzying series of developments in both countries, India this week announced the closure of 37 mines.

These Asian giants are both rapidly pivoting away from coal power, despite the myths peddled by the White House on the subject. The global consensus is moving swiftly towards seeing coal for what it is: old news.

Share