IEA boosts outlook for EVs

International Energy Agency changes estimates of electric vehicle uptake.

By Matt Finch

Share

Last updated:

What do you do when your crystal ball is just not working properly? That is the question that must surely be vexing minds within the Paris-based International Energy Agency (IEA) at the moment, since it is engaged in a game of “let’s copy the oil majors”.

In September I blogged about the oil majors, and how they have changed their tune, via their annual prediction reports, over the last few years when it comes to how many electric vehicles (EVs) there will be on the roads in the coming years. In that blog, I pointed out that the oil majors couldn’t agree amongst themselves how many cars there would be, and also pointed out that their estimates have increased quite dramatically over the last couple of years.

Well, today the IEA publishes its annual report on the global energy landscape. It produces the World Energy Outlook every year (the 2018 version is here), a publication that is all encompassing and looked forward to in wonk-land. It also (helpfully) produces a Global EV Outlook (GEVO) every year too. Crucially, the IEA, in theory, should be neutral. Whereas the oil majors obviously have a vested interest - to both their current shareholders and their future profits - in having fewer EVs on the road in the future, the IEA should not. Its mission is to provide (and I quote directly from its homepage) “data, analysis and solutions on all fuels and all technologies; helping governments, industry and citizens make good energy choices”.

Changing estimates

So, how has it been doing?

Well, in a similar fashion to the oil majors, it has quite dramatically changed its estimates. The IEA envisage two future scenarios - the first, effectively the baseline scenario is entitled the “new policies” scenario - estimating numbers based on all existing policies and all current commitments that should translate into future policies. This scenario, for instance, takes into account China’s intention to set a date for a complete ban of new sales of combustion-engine cars - we know it’s coming, but we don’t know the date and how that law will be implemented (realistically this should be called the business-as-usual (BAU) scenario).

The second scenario is called “EV30@30” in the EV outlook report, and the “sustainable development scenario” in the World Energy Outlook (WEO). This scenario works backwards from what’s needed to achieve the Paris Agreement and the Sustainable Development Goals in full, and is therefore the ‘aspirational’ scenario (EV30@30 is a goal to have a 30% market share for EVs by 2030).

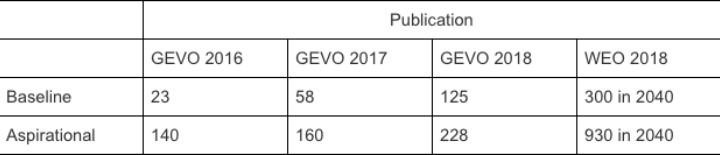

Here are the IEA’s predictions for how many (millions of) EVs will be on the roads globally in 2030:

So straight away we can see that in the space of just three iterations of the Global EV Outlook, the IEA has raised it’s BAU estimate by 443%, and its aspirational estimate by 62%. Cheekily, it has started referencing 2040 as the go-to ‘far-away’ date in this years WEO, but at first glance the 2040 figures seem consistent with the 2030 figures from its GEVO 2018 predictions.

Have the world’s collective EV policies changed that much in just 2 years? No. It is noticeable that the IEA’s prediction on how many EVs will be on the roads in 2030 if there are no further changes in policy (125m) is very nearly the same as its aspirational prediction (140m) just two years previously. All we can therefore really extrapolate from this then is that EVs are coming at a pace that has caught professional industry watchers completely off-guard, and we really should not be surprised if these figures are revised upwards again in the next few years.

Disruptive technologies

A couple of thoughts, though:

For some context, there are about 1.1 billion cars globally on the roads today. The IEA expects there to be 80% more cars in 2040 - about 2 billion. So even though the IEA’s most optimistic assumption of 930m EVs in 2040 sounds like a lot, that still only equates to just under half the global vehicle total. Thought one: why would that be?

The cost of running an EV (practically anywhere globally) is already cheaper than running a similar combustion vehicle now. The upfront cost of an EV is expected to match the upfront cost of a combustion vehicle around 2025 (and will probably continue getting cheaper after this date, whereas fossil-fuelled cars will not). So why - unless there are major supply constraints - would anyone, anywhere want to buy a fossil vehicle post-2025, unless they absolutely have to?

Thought two: electric drivetrains are clearly disruptive, and one thing about disruptive technologies to bear in mind is that they are, well, disruptive (just ask Kodak, Blockbuster Video and seemingly half the UK high street shops out there). Those organisations and companies that expect there to be a ‘linear transition’ are just plain wrong.

In the real world, this actually means that a) sales of fossil cars could start decreasing very quickly (perhaps post-2025, for the reasons mentioned above) and that b) some of the companies currently operating in the automotive industry supply chain will cease to exist over the next couple of decades. What remains to be seen is which of the automotive players will actually be left standing.

Share