What's in my energy bill?

Gas prices, 'green levies', company profits - what's changing, and why?

By Richard Black

@_richardblackShare

Last updated:

What are we paying for?

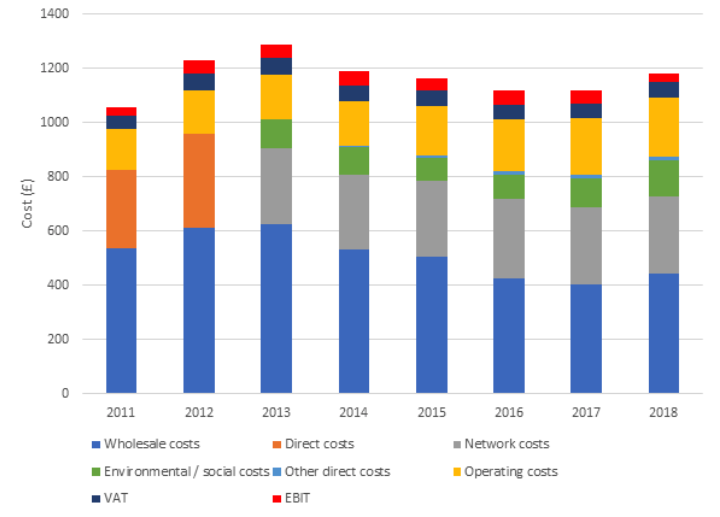

The wholesale price of gas and electricity accounts for nearly 55% of the average UK dual fuel energy bill, according to the regulator Ofgem. In addition to these direct energy costs, bills also include the costs of transporting gas and electricity, environmental and social policies, VAT, and supplier profits.

Household bills almost doubled in the decade to 2014, data from the (now-defunct) Department of Energy and Climate Change (DECC) show. Most of this increase was due to rising energy costs, controlled by factors such as geopolitical supply. Only about 20% was due to low-carbon policies, according to the Committee on Climate Change (CCC), which advises the government on emissions targets.

2015 marked a reversal: both energy prices and household bills fell, following fuel costs.

In 2018, bills rose again slightly due to rising wholesale costs through commodity prices increasing. The government now projects much slower rises in residential power and gas prices in coming years, compared with the previous decade, and some years see marginal falls in price.

Wholesale energy prices are the biggest single contributor to bills, at 38% of the total. Natural gas (methane) is the most significant fuel, accounting for nearly two thirds of domestic energy use, for heating (space and water) and for cooking.

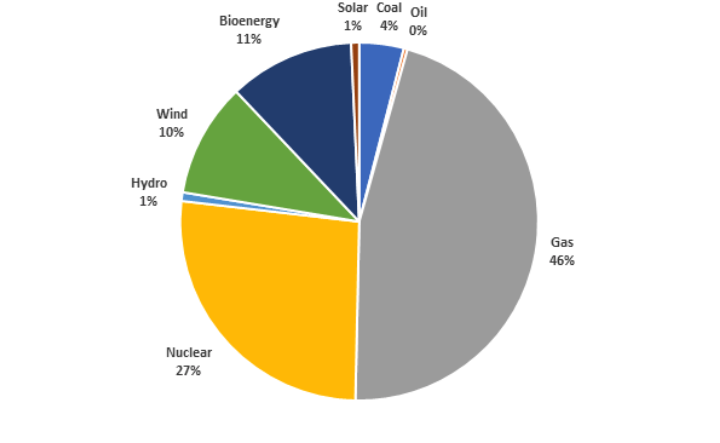

Gas is also a significant fuel indirectly, through its contribution to electricity generation. Electricity accounts for a quarter of domestic energy use. 46% of electricity was generated through gas in 2019, and half was generated from renewable (23%) and nuclear power (27%).

Since spring 2016, coal use for power generation has plummeted, with gas and renewables making up the majority of the difference. Britain plans to phase out coal by 2024 and has had a coal free system for over two months during summer 2020.

What affects the wholesale price?

Wholesale gas and power prices are determined by the balance of supply and demand in their respective markets. Gas supply is dependent on domestic production and the availability of (and therefore cost of) molecules from the UK’s main suppliers: Norway, Belgium and Qatar, with demand largely a function of temperature in the UK.

Gas wholesale prices (referred to as NBP) are highly intertwined with those in Europe, mainly in the Netherlands and in Germany. Any market moving events in these countries, such as outages or pipeline breakdowns, will affect UK gas prices.

Electricity supply is determined by available power station capacity, the weather conditions that determine output from the UK’s wind farms and solar parks, and the cost of power imported from overseas. Demand also largely tracks temperature, but fluctuates during the day to fit with daily life.

The direction of wholesale fossil fuel prices is hard to predict. However, the International Energy Agency expects global gas prices to remain low as a result of ample supplies, and prices across continents to get more similar. Coal usage is expected to remain stable as the Chinese and Indian economies grow and production of coal in China is expected to grow despite coronavirus, stabilising the price of the fuel.

While the wholesale power price is not driven by coal prices in the UK, it affects the price of electricity in France and the Netherlands, countries from which the UK generally imports power.

Wholesale prices are also affected by the exchange rate, with fossil fuels traded in US dollars and the UK’s gas price tending to follow the price of gas at America's Henry Hub and the Netherlands TTF. Weaker sterling will increase the cost of importing these fuels, which will pass through into customer bills.

The proliferation of renewable generation capacity has also suppressed wholesale prices, with output from wind and solar power undercutting traditional generation.

Government ‘green’ policies

The phrase 'green levies' is sometimes used as a shorthand for government measures intended to encourage expansion of low carbon power, to subsidise home insulation and to tackle fuel poverty. These levies were a focus of growing concern when energy bills were rising in the years up to 2014. Prime Minister David Cameron is rumoured to have referred to them as 'green crap'.

In fact, these levies account for only about a tenth of household bills. They can be divided between support for energy efficiency, especially to help the less well-off insulate their homes, and for low-carbon electricity technologies. Also, many vulnerable households also benefit from lower energy bills as a result of low-carbon support and energy efficiency.

Because support for efficiency reduces energy consumption, the net effect of these low-carbon and efficiency measures is to reduce bills overall. Analysis has shown that energy bills have now fallen back below 2008 levels.

Green levies will rise through the early 2020s, as energy companies progressively switch to a cleaner power system and invest in energy efficiency. From mid-decade, a surge in low-cost renewables coming onto the grid will help to bring bills down.

However, the Government has set a price cap above which bills cannot go any higher, and many lower payments can be secured through switching energy suppliers regularly.

Transporting and distributing energy

The network for transporting gas and electricity comprises a combination of high capacity, national transmission lines, and more local distribution systems to the end consumer.

Network costs account for nearly a quarter of consumer bills. The cost of the distribution network accounts for most of this and the operators of the distribution network depend on where you are in the country, as it is a monopoly system.

Operating costs have risen slightly over the last decade, as new power sources like wind and solar have been connected and the system upgraded.

Energy network companies have come under scrutiny for the profits they make. Analysis by Citizens Advice found that households are overpaying by £7.5 billion, with particular focus on the electricity distribution networks. Ofgem announced proposed parameters for the next round of network price controls in summer 2020, which will reduce the profits these companies can make.

Energy company profits

Electric utilities pass their running costs on to consumers. These costs account for about 18% of bills, says Ofgem. In addition, suppliers extract a profit margin, which they need for reinvestement and to reward shareholders. That margin has recently varied between 1% and 9% of consumer bills, according to Ofgem.

A big question is whether suppliers are making excessive profits, at the expense of consumers. Ofgem raised concerns in 2011 that the 'Big Six' utilities faced too little competition. Since then, it has forced them to report profits in each segment of their business and has opened up the market to smaller suppliers. And in 2015, the Government successfully forced suppliers to simplify their tariffs and allow easier switching of suppliers, as nearly 6 million people switched in 2019.

Still worried about fairness, in 2014 Ofgem referred the energy market to the Competition and Markets Authority (CMA).

The CMA reported provisional findings in mid-2015, declaring that the 'Big Six' were over-charging consumers on standard tariffs and that consumers could make big savings from switching to alternative suppliers. The CMA concluded that the 'Big Six' had 'unilateral market power' which allows them to exploit customers. It said they were charging households more than smaller independent suppliers, and were charging about 5% more than might be expected in a competitive market.

Final results were released in 2016, with onlookers accusing the CMA of watering down its findings: the major change will be the formation of a database containing details of customers, while households on prepayment meters or a standard variable tariff will have their bills capped at £1,137 for 2020.

However, some energy companies are setting their tariffs at just below the price cap, arguing that they cannot continue to operate on limited profit margins. Switching tariffs can save you up to a third more than relying on the price cap, with many customers moved onto higher cost standard variable tariffs as introductory deals end.

And the future?

Forecasting energy markets and bills is notoriously difficult, and relies on numerous assumptions. Both the government and analysts expect wholesale energy prices to remain low, or to rise only slowly, for the rest of this decade.

The recent move to limit energy network profits should limit upward pressure on bills, but investment needed to make sure the energy networks are modernised will impart some costs onto households.

Cheaper renewables replacing older, higher-priced contracts will also help to bring bills down, but some of this will be cancelled out when generators at Hinkley Point C begin to produce electricity.

Another change we can expect is the roll out of smart meters which was delayed by 4 years in 2019 due to concerns over the technology’s readiness. For customers, they may allow a switch to cheaper, 'time-of-use' tariffs, if they can use less power during peak periods. For utilities, they will cut costs by bringing an end to property visits for manual meter readings.

Share