Contracts for Difference: Government on course to steer scheme to build offshore wind out of troubled waters?

The Government has announced new maximum strike prices for its Contracts for Difference (CfD) scheme today after failing to secure any new offshore wind in its previous auction.

By Jess Ralston

@jessralston2Share

Last updated:

The starting price of the government’s next auction for offshore wind by has been raised by around 75% to £73 per megawatt hour. The government also raised the starting price for floating offshore wind projects by more than 50% from £116 a MWh to £176 a MWh before the next subsidy auction in 2024. However, the auction process could drive bids much cheaper than the maximum set price.

It means offshore wind companies can continue ramping up installations – reducing our dependency on gas and potentially lowering bills for UK billpayers - and brings the UK closer to its target to deploy 50GW of wind by 2030. This is also vital for UK energy security, with UK wind power contributing over a quarter of the nation’s total electricity generation, up from 14.6% in 2013.

Previous strike price didn’t reflect rising inflation and gas prices

Renewable developers didn’t bid in the previous CfD Allocation Round (AR5) earlier this year. In AR5, the strike price didn’t account for the impact of the gas crisis on supply chains and all infrastructure projects, along with rising inflation and post-pandemic demand for materials. This was despite developers warning the Government about mounting costs.

The auction could have delivered an extra 5 gigawatts of power, instead the lack of bids has dealt a blow to the Government’s target of 50GW of offshore wind by 2030, and cost billpayers £1bn a year in missed savings.

With the costs higher and the price on offer low, in effect renewables companies were in a bind, unable to bid at unfeasibly low rates. The Irish Government allowed for supply chain inflation in its recent auction, which has successfully secured 3GW of offshore wind capacity at competitive prices.

How 'Contracts for Difference' works

Contacts for DDifference awards 15-year price guarantees for low carbon power generation such as wind and solar. And as the main mechanism for supporting renewables, CfDs are a strong indicator of whether the UK remains competitive on green investment while other countries accelerate towards net zero.

Offshore wind powers ahead

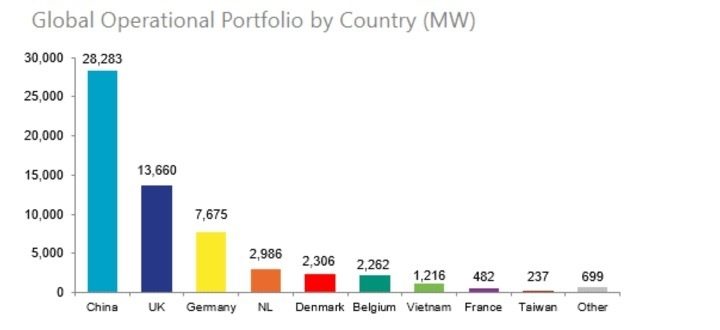

The new turbines churning off the coast, making Britain a world leader in offshore wind, are being built thanks to Contracts for Difference. These Government contracts offered critical certainty to investors when the industry was on the cusp of a huge expansion. The UK had the largest fleet of offshore windfarms until 2021 and is now second only to China. Currently, wind (offshore and onshore) supplies about a a quarter of the UK’s electricity needs.

CfDs have been a great success for Britain’s power sector, helping the nation decarbonise while harnessing an abundant offshore resource. In 2008, just 6% of the UK’s total energy consumption came from low carbon sources and four fifths was derived from fossil fuels. In 2020, renewable electricity generation overtook fossil fuels for the first time

accounting for 40% of power.

Global operational offshore wind portfolio, Feb 2023

Why strike price matters

A strike price guarantees a price per megawatt hour of electricity for 15 years. These guarantees offer security to renewables companies, meaning they can front build costs for windfarms without worrying about price volatility once it’s up and running. This stability in turn brings down financing costs and so, ultimately, consumer bills.

If market rate for electricity is higher than the strike price, renewables pay back the difference effectively taking money off bills. If the rate is lower than the strike price, revenues are topped up through levies on bills. In general, new renewable power generation is cheaper than gas power plant prices – which set the market rate – so strike prices tend to result in bill payers being reimbursed.

Cost to billpayers for failed Allocation Rounds

Offshore wind power remains cost competitive with forecast wholesale prices set by gas for the middle of this decade at the maximum strike price. Competition could drive offshore wind prices below market prices and deliver bill savings. The UK had 5GW of offshore wind projects ready to go but because wind companies did not bid in AR5 and could now be delayed. If they had secured contracts, they would be paying bill payers back £1 billion a year by the mid-20s.

There could be an additional 3GW of offshore wind secured in AR6, taking the total to 8GW. If the Government had ignored industry calls, and again got zero bids, then it may have squandered the chance to reduce imports of liquified natural gas (LNG) by half and leave the UK dependent on 7 million homes worth of gas each year. We’ll have to wait to see the final results of the auctions to see whether it’s avoided this fate.

Failing to secure these offshore wind contracts would mean the Government going into reverse on the energy crisis, not reducing demand for expensive gas power, and bills are likely to remain higher for longer. For the next strike price, the industry had asked the Government to raise limits by 25-70% to offset rising costs, so the maximum price announced is broadly in line with this.

What about gas?

The maximum strike price for offshore wind is cost competitive with market prices predicted out to 2030, when the renewable projects are likely to come online. Onshore wind and solar remain tens of pounds cheaper. Gas prices are volatile and at the mercy of global conflicts, first Russia’s invasion of Ukraine, now the conflict in Gaza. By February 2023, the gas crisis had already cost every adult in Britain £1,000, totalling £60 billion.

Lowering bills in Britain means shifting away from volatile gas markets. And for the nation as a whole, the International Energy Agency, Climate Change Committee and Office for Budget Responsibility all note the UK’s energy security depends on building renewables. The North Sea is running out of oil and gas, experts warn. The Government can offer licenses to search for it, but they may come back empty-handed. Without building renewables to replace fossil fuels, Britain will be dependent on unpredictable foreign supply for years to come.

A single large windfarm with a capacity of 2.7GW would be enough annually to replace all the new North Sea oil and gas licenses impacted by a proposed Labour moratorium on drilling. And unlocking the UK’s offshore wind capacity could deliver a £92 billion boost to the economy by 2040.

North Sea oil and gas may have once kept the lights on, but now this island nation is tapping into a more abundant resource. With the right strike price, AR6 has the potential to get Britain closer to energy independence and no longer hooked on gas.

Share