Net zero: cars, lorries, buses and trains

How can the UK's road and rail fleet emissions be cut to zero?

By Peter Chalkley

Share

Last updated:

Where are we now?

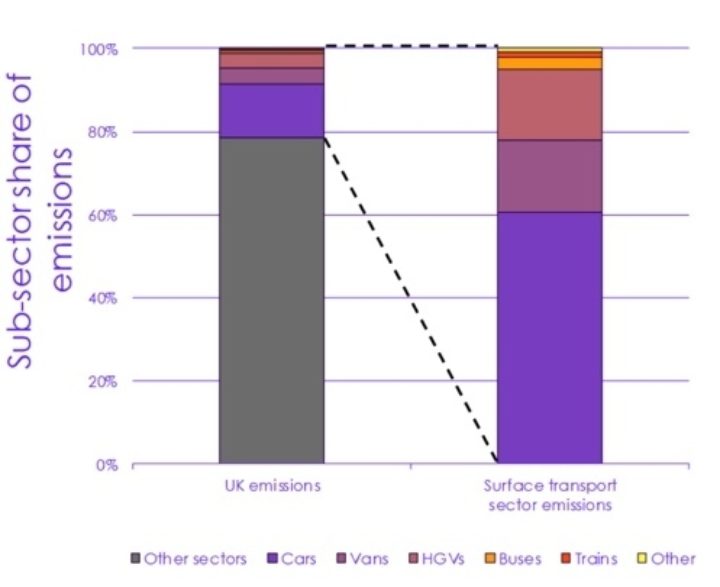

Emissions from transport have fallen slower than those from other sectors. As such, it is now the single largest UK source of emissions, accounting for 34% of emissions in 2019.

Transport emissions peaked in 2007, and have now fallen back to 4.6% below 1990 levels, down 3% from 2018 to 2019. Rising passenger miles and the persistence of fossil fuel vehicles are the reasons for this sector lagging behind others.

Over half of transport emissions come from cars. HGVs and vans each account for around 15%, while buses and rail emit less than 5% each. International aviation and shipping are accounted for separately.

Road Vehicles

In 2020, the Government announced plans to end the sales of new conventional petrol and diesel cars and vans by 2030, and hybrids by 2035. To this end, battery electric vehicles (BEVs) will likely become the norm for passenger vehicles, particularly as charging times shorten, ranges increase and more charging points become available. Ranges for BEVs are increasing rapidly, with some vehicles able to travel 375 miles between charges.

As of October 2020 there were approximately 375,000 plug-in cars on the roads, up from just 3,500 in 2013. This number includes plug-in hybrids, but sales of these are expected to fall over time as BEV technology improves.

Currently combustion engine vehicles (diesel and petrol cars) are, on a like-for-like basis, less expensive to buy than BEVs, but that is expected to change in the mid 2020s.

Running costs of BEVs are already a lot cheaper than comparable combustion engine vehicles. Electricity is cheaper than fuel; and with fewer moving parts, BEV maintenance costs are lower.

Taking purchase and running costs into account, BEVs have similar overall costs to petrol and diesel cars in the first few years of ownership.

Among others, Deloitte and VW expect electric vehicles to reach cost parity with those powered by internal combustion engines within a few years. For true net zero emissions, cars depend on their power supply being clean at source (see briefing on net zero power).

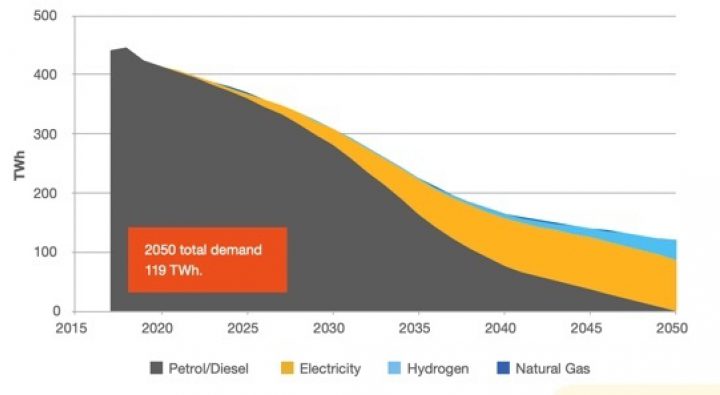

Electric vehicles are also more efficient than fossil fuel alternatives. As all cars become ultra-low emissions by 2050, the annual energy demand for road transport is predicted to fall by around two-thirds, to around 150TWh per year (from around 450TWh in 2017.

Smart charging will help to ‘smooth’ peak demand by shifting charging times to when overall demand for electricity is lower, with market mechanisms driving this shift. Large numbers of BEVs connecting to the grid could require some local electricity networks to be upgraded and the Government recently committed £1.3 billion to support the roll-out of charging infrastructure. However, electric vehicles could also help to support the grid by providing electricity back when parked - this is known as ‘vehicle-to-grid’, and a number of Government-funded trials are underway.

The Nissan Leaf, which has its European manufacturing site is in Sunderland, was the world's best-selling BEV in 2017 but has been overtaken by other models such as the Tesla Model 3 now. In 2016, one in five battery electric cars driven in Europe was built in the UK, however in recent years China has taken over, due to Chinese Government policies put in place several years ago. London is already deploying electric taxis that have been manufactured in Coventry, which are now also being exported to the Netherlands.

The drive towards BEVs is global. China is in the lead, having deployed nearly2.5 million electric vehicles by 2018, which is nearly half of all the electric cars on the road world-wide. Within Europe, Norway is the out-and-out leader: in 2017 sales of BEVs made up 21% of the total. By 2019 46% of cars sold in Norway were fully electric.

Buses

The UK boasts a number of electric bus manufacturers including Alexander Dennis, Optare and Wrights Group which operate in cities across the UK. London has the largest electric bus fleet in Europe at over 200 buses with ‘more to come’; the Prime Minister promised 4,000 new zero-emissions buses in a 2020 transport funding package. Roughly 17% of the total global municipal bus fleet is currently electric. Shenzhen, in China, has already electrified 100% of its bus fleet, a total of 16,359 buses.

Lorries

Whilst it is expected that smaller vehicles will be battery powered, the likely technology winner for decarbonising larger vehicles is a lot less certain. Tesla has announced the imminent launch of the electric ‘Tesla Semi’, a lorry capable of a 500 mile range on a single charge. Chinese firm BYD has electric trucks already commercially available in China.

Other potential solutions include hydrogen-powered fuel cell propulsion, and electrifying some of the strategic road network.

Hydrogen can be generated through electrolysis, using an electric current (e.g. from renewable or nuclear energy) to split water into hydrogen and oxygen. It can also be made by steam reforming of methane, with the carbon dioxide generated being captured and stored.

The world’s first electrified road opened in Sweden in April 2018. In the UK, ‘zero-emission technologies for HGVs are further from the market’ than vehicles like cars and although the exact future is uncertain, zero-emission HGVs are likely to include a variety of battery electric, electric road systems (where the buses connect to overhead electric lines) and hydrogen fuel cells.

Trains

The British Government has announced that all diesel trains will be removed from the rail network by 2040. Around 42% of the UK’s rail network is currently electrified, with the vast majority of the rest being diesel-powered. This is relatively low compared to electrification rates in the Netherlands (76%) and Italy (71%).

Electrifying lines carries high upfront capital costs. Costs were partly behind the £38bn rail electrification programme (announced in 2012) being abandoned by Government in July 2017.

Potentially the most likely alternative to full electrification of the rail network is to use hydrogen fuel cells to power trains. The hydroFELX hydrogen train was launched in September 2020 after receiving £750,000 of investment from the Government. By 2023, it is expected that the technology could be retrofitted into trains currently in use although this could compete with electrification of trains.