Reheating the shale gas debate will not solve the gas crunch

The gas crunch gripping Europe is directly caused by volatile international gas markets, highlighting the benefits of weaning ourselves off fossil fuels and that the wisdom of rejecting fracking.

By Dr Simon Cran-McGreehin

@SimonCMcGShare

Last updated:

The gas crunch gripping Europe is directly caused by volatile international gas markets that expose the UK to demand surges in Asia and political manipulation by Putin. This crisis highlights the benefits of weaning ourselves off fossil fuels – to stabilise our energy market, whilst achieving our climate goals.

However, fossil fuel enthusiasts are actually suggesting the opposite, by demanding that the UK should revisit its unsuccessful dalliance with fracking for shale gas. Although they try to spin an enticing tale, there’s simply no point in rehashing the debate – and recently the Secretary of State at BEIS again ruled out drilling for shale in the UK. Fracking would fail now, just as it failed in the 2010s – the problems are still the same, and the industry simply can’t make its sums add up, let alone win the trust of the public.

Supporters of fracking are once again pointing to the US, where the practice exploded across vast swathes of countryside, cutting US gas prices and making that country a net exporter of gas – the UK, they claim, could do the same. But the fact is that the UK couldn’t simply jump straight to a gas boom that took the States 20years of preparation, let along overcome major challenges specific to this side of the pond.

Fracking in the UK is thwarted by geology. Unlike in the States, the UK’s shale reserves are split into smaller pockets that would be harder to access – and of those reserves that could be accessible, three quarters would have to be left alone to avoid disrupting homes and infrastructure. These challenges would make UK shale three times the price of US shale and twice the price of imported LNG.

Overall, it was concluded that UK shale gas would have little impact on energy prices, consumer bills or GDP. And yet shale supporters are reheating their argument that UK production would somehow isolate us from international prices – whereas the reality is that UK shale would still be part of the international market. Prices would be affected by overseas demand (and political interference) – we’d have to pay the market rate, otherwise the gas would be exported to those who were willing to pay. What’s more, UK shale wouldn’t meet our demand, so we’d still be importing gas – again at the market rate. Whichever way you cut it, shale would keep the UK locked into the volatile international gas market.

Not under my back yard

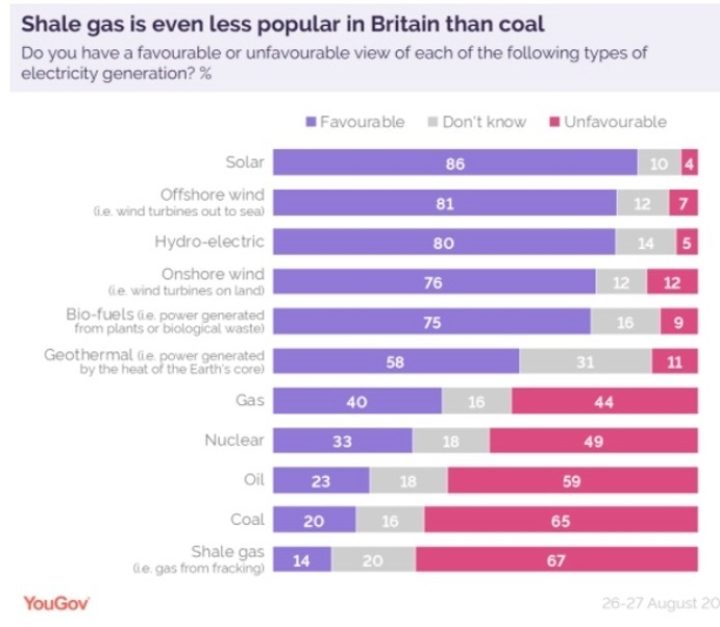

Fracking was remarkably unpopular with the public, with the UK Government’s own surveys in 2019 finding that opposition to fracking outnumbered support by four to one. Polling by YouGov showed that fracking for shale gas was the most unpopular source of electricity generation, with 65% seeing is as unfavourable – in stark contrast to support for renewables (see chart). At that point, the Government decided that shale gas was not worth supporting and announced a moratorium on fracking.

This strong level of opposition has been maintained. There are doubts over the industry’s ability to manage health risks like water pollution, anger over disruptive industrial activity near to homes, and fears about the earthquakes caused by fracking. Compared to the States, these issues are amplified by the UK’s higher population density – as noted by Kwasi Kwarteng in recent days – and landowners have less involvement because our mineral laws give the Government the rights over gas exploration.

With the arguments stacked against fracking, reconsidering shale isn’t worthwhile – and, with such strong public opposition, could lead to the loss of votes.

No backtracking

Just this year, we were reminded that the risks of fracking haven’t changed. The Climate Change Committee wrote the UK Government recommending the continuation of the moratorium, observing that any longer-term role for shale is economically risky – its high costs make even less sense as the UK moves away from gas.

Strategically, shale just doesn’t make sense in the transition to net zero. It would require investment in fossil fuel infrastructure at the time when that system will be winding down – possibly leaving stranded assets behind. And all for a fuel that’s hard to justify in a future low-carbon economy, requiring carbon capture technology (which has not yet been demonstrated at scale) and deeper emissions reductions elsewhere to compensate for methane leakage from fracking wells.

Diplomatically, with the UK hosting COP26 this year, fossil fuels are a no-go area for the UK Government – as demonstrated by the outcry over proposed coal mining at the Woodhouse Colliery. It’s simply not tenable for the UK to promote shale gas, particularly given the rising international concern over methane leakage. The IPCC recently confirmed the gas to be a major climate threat, and the US and EU have pledged in the run-up to COP to curb emissions of methane by 30% by 2030.

On track to net zero

The best way to boost our energy security is to continue our transition to net zero. Installing insulation to upgrade the average home from EPC band D to band C, would cut average households gas bills by at least 20%. If all homes currently rated EPC band D or worse were upgraded to band C, then the UK would reduce its net gas imports by around 15% (see footnote).

And home-grown renewable electricity to power heat pumps can cut our home gas bills completely. The upcoming Heat and Buildings Strategy is the key opportunity to make up for lost time on insulation upgrades, and is expected to offer households £7,000 in support for heat pump installation.

With low-carbon energy holding such potential and enjoying such strong public support, the UK should continue its transition to clean, affordable energy – forgetting the shale gas pipe dream and leaving Putin’s international gas market behind.

Footnote

Estimated reductions in net gas imports via buildings energy efficiency were calculated as follows. Data from 2019 was used, because a) that is the most recent year for which both EPC and UK gas demand data are available, and b) to avoid the impact of the pandemic upon gas demand.

- NEED, sheet 27: Gas consumption by Energy Performance Certificate (EPC) Band. This is 2019 data for England and Wales. For each EPC band (and homes of “unknown” band), this table states mean annual gas demand and number of homes in the band. From this can be calculated the total annual gas demand of this sample (245TWh for 18.3million homes in 2019), and how much gas would be saved if all of the homes in bands D and above (including “unknown”, since their average demand is higher than D) were improved to band C standard (and assuming that homes in bands A-C did not change): this comes to 51.2TWh, which is 21% of the total gas used in those 18.3million homes.

- The NEED EPC data covers most of the 85% of homes in England and Wales that use gas, but does not include homes in Scotland or Northern Ireland. Overall, such a sample is considered to be reasonably representative of the UK, and so the figure of 21% savings in gas in this estimate is applied across the UK’s homes that use gas.

- DUKES Chapter 4: Natural Gas. This is 2019 data for the UK. This states total demand as 878TWh, imports as 518.1TWh, exports as 87.7TWh (and hence net imports were 430.4TWh, or 49% of total demand), and domestic (i.e. household) demand as 309.9TWh (35% of total demand).

- Applying the 21% saving in domestic demand equates to 7.4% of total UK demand. Assuming that this would be entirely deducted from net imports, this would equate to a 15.2% cut in net imports.