UK solar - left in the shade

New IEA forecasts see a global solar boom, but the picture is less sunny for the UK

By Jonny Marshall

Share

Last updated:

Attention-grabbing statistics in the International Energy Agency’s latest update on the future of global renewables makes stark reading for those of us with an eye on Britain.

Not only do the Parisian boffins see distributed solar PV driving a rapid increase in low carbon electricity capacity, they also see self-consumption upending markets all around the world, as commercial and industrial energy users install cheap panels and reduce reliance on the grid.

The numbers for the UK, however, look somewhat at odds with those in other countries – both near and far. Opting for a different path is shown clearly in the IEA’s five-year look-ahead, and could see Britain’s power system looking very different to that in other countries by the middle of the next decade.

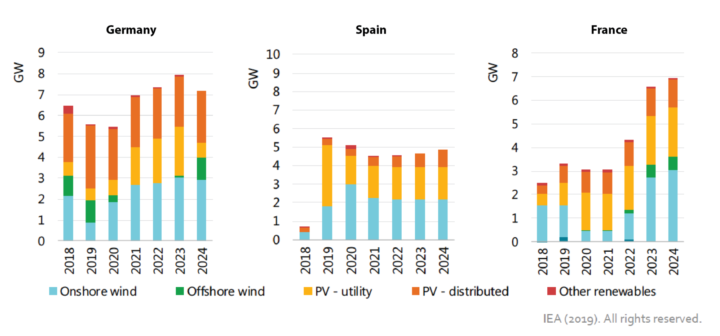

Offshoring

As ever, the closest comparators for the UK are neighbouring European nations. Following a slowdown in last year’s forecasts, the IEA now see a surge in clean kit coming online in Germany, Spain and France, driven mainly by onshore wind and solar PV. Germany will see up to 8 GW of renewables built, per year, through to 2024, almost all of which is onshore wind and solar, while Spain is set to add more than 4 GW of offshore wind and solar combined in each of next five years.

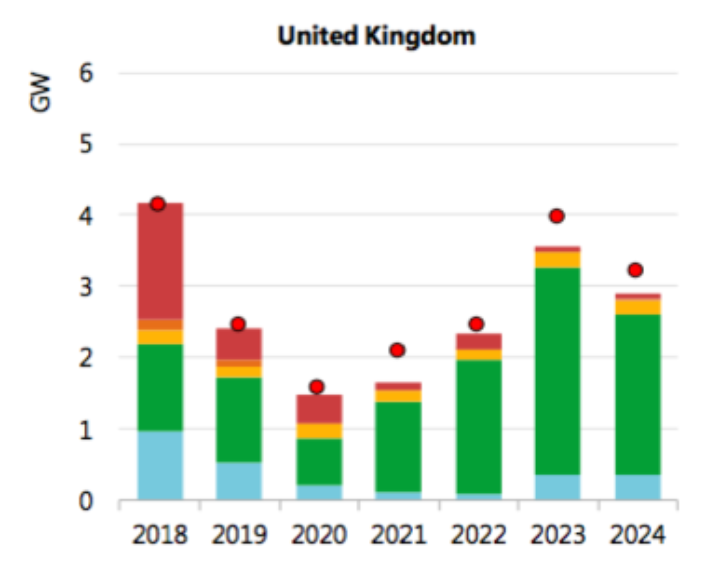

Looking at the UK, and the picture is a little different, the IEA notes that offshore wind is responsible for more than 70% of new capacity to 2024. In the other European countries in focus (apart from the Netherlands where it represents around 20%) it is little more than a footnote, as countries focus on the quickest to build and cheapest generating renewables.

And while the recent auction for offshore wind support contracts cleared well below expectations, the ability of remote-island onshore projects to match these costs suggests that ‘mainstream’ onshore wind would be even cheaper, were it allowed access to technology-neutral CfD auctions.

Unloved

The third largest source of new capacity over the next five years, after offshore and remote island wind is bioenergy, with 1.3 GW set to be commissioned by 2024. Added onto the vast amount of wood burnt for power at Drax, and the UK will be further supporting technologies whose sustainabilityand emissions neutrality are heavily contested.

Behind biomass, in fourth posiiton, sits solar PV. The IEA anticipate an expansion of 1.2 GW to 2024, or just 11% of capacity added over the five years from 2013-18.

Over the same timeframe Germany is looking to add more than 20 GW of solar, with France and Spain both expanding by more than 15 GW. Even Poland is expected to install more solar capacity than the UK between now and 2024. Turkey, Italy and Belgium will also comfortably outperform the UK.

In response to criticism relating to the slowdown in installations and removal of policy support for solar, the Government increasingly points to the Smart Export Guarantee (SEG). The SEG scheme will compensate owners of PV systems for power that they export to the grid, and is set to come into effect in the new year. However, the IEA is less positive, saying ‘this new policy is not anticipated to significantly boost household PV deployment’.

Utility scale projects remain, of course, excluded from CfD auctions. All eyes will be on the upcoming Energy White Paper to see if this situation will persist.

Cash money

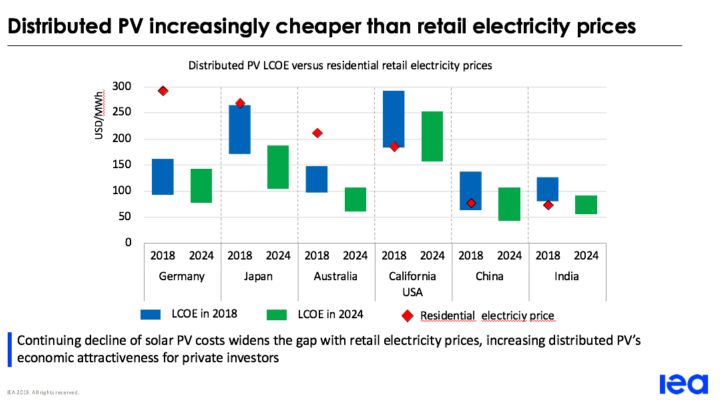

An excellent figure from the IEA shows just why solar PV is set to boom. Undercutting retail electricity prices by increasingly large amounts strengthens the case for rooftop solar, hence why the IEA see commercial and industrial users installing capacity to cut energy costs providing the bulk of this type of capacity, rather than households.

This raises questions about distribution of fixed costs, such as the kit needed to keep the grid balanced, and the costs associated with upkeep and repair.

Long identified as a danger point, the time at which the pool of billpayers are at risk of being left to pay for grid energy begins to shrink is looking increasingly near. In Britain, nearly two-thirds of electricity is used by commercial and industrial consumers. Were a noticeable proportion of this sector to start investigating below-retail-price solar PV, homes could be left facing higher bills.

The rapid expansion of distributed solar in other countries should, hopefully, give UK policymakers plenty of food for thought so that when – surely rather than if – the solar boom makes it to UK soil, vulnerable households and smaller businesses are not left picking up more of the bill as others.

Share