Energy prices - how the UK compares

As energy prices continue to rise and governments act to help consumers afford their bills, we look at the UK prices in comparison with our neighbours.

By Gareth Redmond-King

@gredmond76Share

Last updated:

After over a year of ever rising energy costs, two things should be crystal clear by now: price rises are caused by gas (not net zero, wokeness or unicorns); and this is a global issue.

Gas is to blame

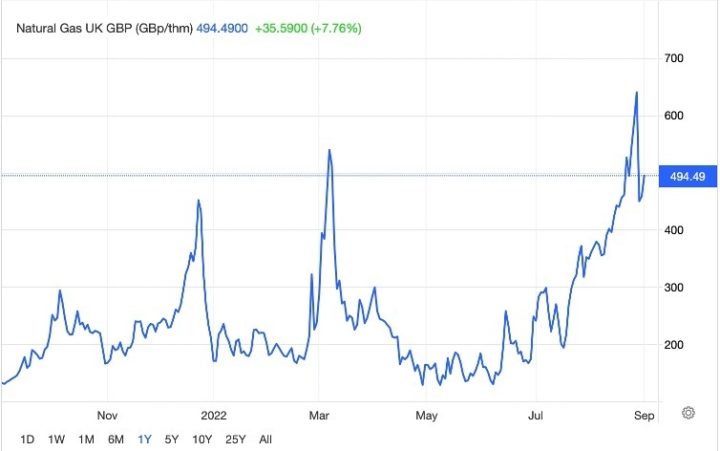

Gas prices started rising in the middle of 2021, picking up pace later in the year, before spiralling upwards after Russia invaded Ukraine in February. Supplies have been constrained – first by a demand/storage mismatch after covid, and then by Putin in retaliation to European sanctions against his country.

Having fallen as low as 9p per therm in May 2020, UK gas cost 45p per therm in late February 2021. A year later, just after Russia’s invasion of Ukraine, that price had risen twelve-fold to £5.38. At the end of August 2022, it spiked at £6.31 before, at the time of writing, hovering just under £5.

That is a phenomenal increase and, because of the way that gas sets electricity prices, it has had a similar effect on power costs. It is estimated that, with continuing lifting of the UK energy price cap, gas will have added £2,300 to the average household energy bill – 95% of the total increase – by the end of this year.

How global is the effect?

Whilst this is a worldwide problem, with global energy markets driving global prices, the effect is not equally felt.

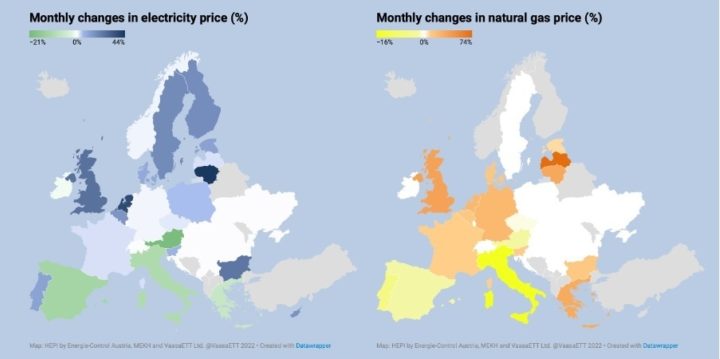

Recent European price analysis by the Household Energy Price Index shows percentage rises for gas and electricity in July. On both, the UK nearly tops the list: 25% rise in power price (surpassed only by the Netherlands and Lithuania), and 37% rise in gas price (beaten by Latvia).

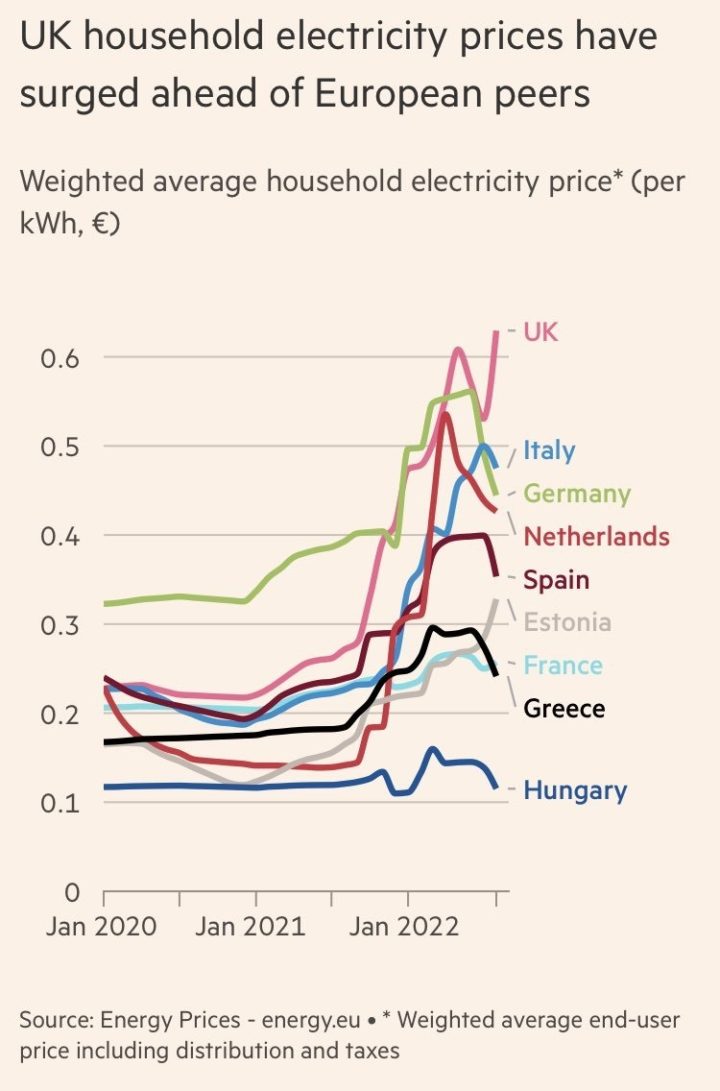

A survey of 2021 power prices, by price comparison site cable.co.uk, put the UK 191st out of 230 countries on price per kilowatt hour (kWh) of electricity.

Across 60 tariffs, Britain came in at $0.25 per kWh – only beaten in Europe by Germany ($0.32 per kWh) and Denmark ($0.35 per kWh). And that was before prices started to rocket.

Another index of prices put recent UK household electricity prices considerably above those of the five largest EU economies.

Prices would be higher still, were it not that over half our power supply is low-carbon. Renewables alone make up just over 40% of our generation, with the cost for new renewables now nine times cheaper than gas. For the full extent of these savings to be realised, the UK’s power market would have to be reformed to stop gas driving prices across all technologies.

UK extremes

New analysis from the International Monetary Fund attributes our high prices to Britain’s reliance on gas. 85% of UK homes are heated using gas, and up to 40% of our power is generated using gas each year – the second highest in Europe (after Italy).

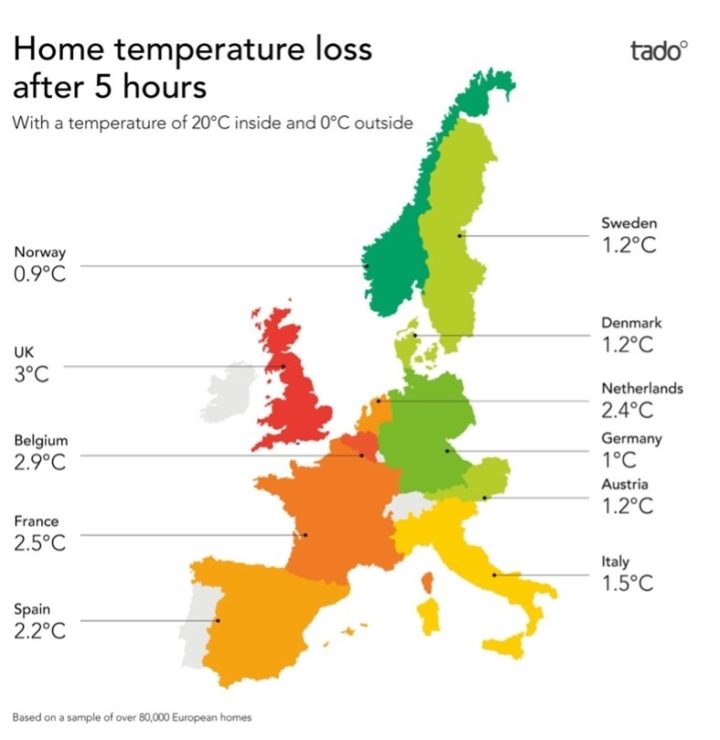

Reliance on gas is exacerbated by energy inefficient homes – again, far worse than most other European countries.

In the early years of the 2010 Conservative/Lib Dem government, the self-proclaimed ‘greenest government ever’ was going great guns insulating homes to reduce energy waste and cut consumption.

However, this fell off sharply after 2012, with rates dwindling since. All of which leaves UK energy consumers very exposed to price rises.

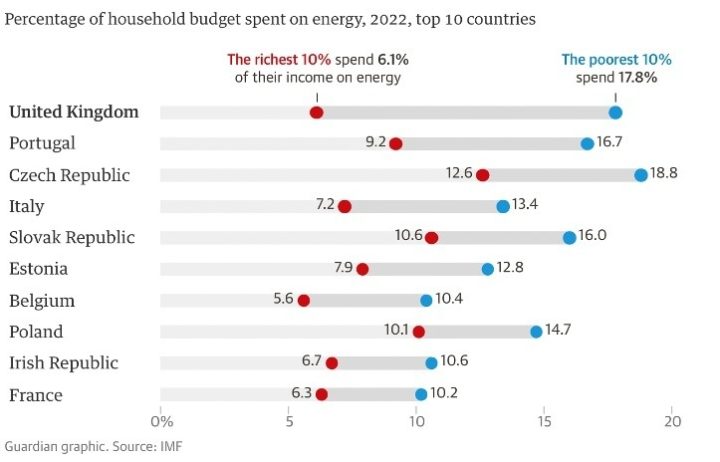

Coming top of the list, again, the IMF calculates the UK will see a cut of 8.27% in spending power, as a percentage of household budgets.

Not only that, but we have the widest gap between impacts for the poorest and richest households; the proportion of household spending on energy required of the former is three times that of the latter.

Energy bills help

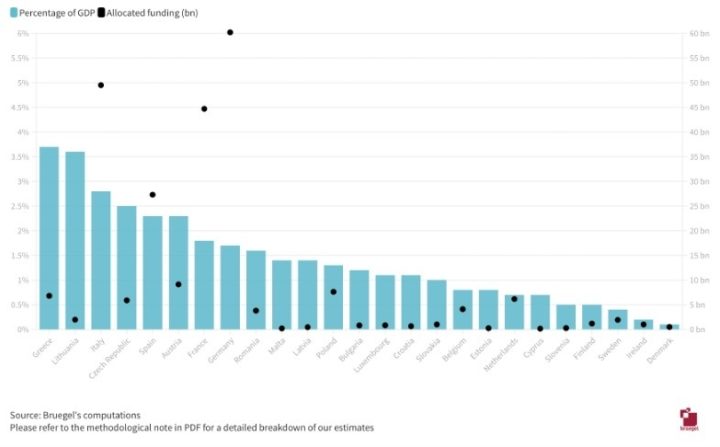

Of course, we’ve yet to see what the UK’s new Prime Minister introduces to provide help with energy bills. But as of the start of September, disaggregating energy bill help from measures on wider cost of living rises, the Institute for Fiscal Studies, for the BBC, estimates the value of UK support for bill payers at £19bn. Whilst higher than many EU nations as a total sum, as a percentage of GDP (0.8%), it doesn’t compare too favourably with the assistance from most of the 25 EU nations analysed by Bruegel to-date.

What next?

All eyes are on the European Commission next. Just the suggestion of emergency measures from the bloc to curb price rises, alongside EU gas storage levels nearing their 80% target, impacted gas markets, bringing the price down temporarily.

In the UK, amidst a leadership election for a new Prime Minister, political rhetoric has centred on increasing domestic flows of gas from the North Sea, or even fracking, to reduce energy bills.

As recently as February, the Climate Change Committee advised they “would not expect increased UK extraction to materially affect global oil or gas prices … even extracting all proven UK reserves and resources from new fields would only meet around 1% of European gas demand each year to 2050.” Additionally, energy analysts Rystad suggest the British market is unattractive for “profit-seeking majors”, as the UK hits another ‘top of a league table’ position with the second-highest operating costs per-barrel of the top 30 oil producing nations. And that’s before reckoning with the CCC’s calculation that average time from exploration to production as 28 years.

It is also somewhat skating past the strong evidence that gas is the problem. As well as gas having added £2,300 to energy bills by the end of this year, it is clear that even existing, limited, energy efficiency policies to cut gas demand have already reduced bills by £600 a year for millions, before recent prices hikes. Upgrading energy efficiency in UK homes can cut gas use by a fifth for those households, and replacing gas boilers with heat pumps cuts gas demand by 80%, leaving only that used to generate electricity.

This leaves attention here, then, on what additional financial respite may come for consumers facing unprecedentedly high, continuing price rises. And what that might do to these comparisons – but more importantly, to people’s ability to stay warm and well this winter.