Future energy security

Rise in British renewables will play a much larger role in bolstering the UK’s energy security than potential new domestic oil and gas production.

Last updated:

The UK’s energy mix is currently dominated by oil and gas, and the decline in North Sea oil and gas production since the turn of the century has caused imports to rise. In 2024, around 66% (two-thirds) of the end-use energy used by consumers requires imported energy. This includes imported gas and oil-based fuels that are used directly, plus the share of electricity that is produced from imported fuels such as gas and biomass.

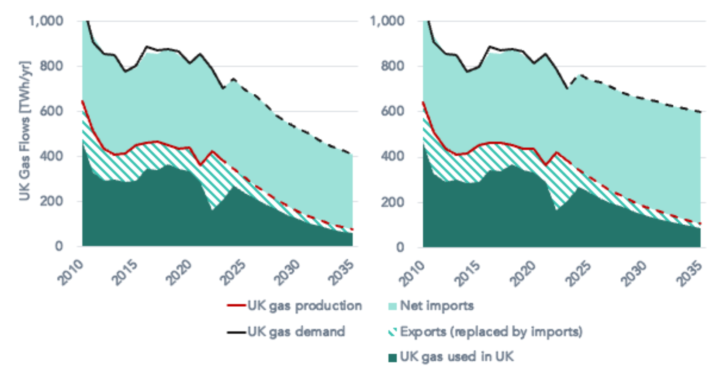

The North Sea Transition Authority projects that UK gas production will fall by 55% by 2030, and oil production by 40%, even if new licences were approved and led to new production. The decline could be steeper, given that new licences are no guarantee of obtaining the projected volumes.

Without a reduction in demand for oil and gas, the amount of UK end-use energy consumption that relies on imported fuels will rise to 82% even with new licences for oil and gas production, which is 1.25x the current level. That is, by this measure, the UK’s energy security will be a quarter worse than today.

UK gas flow data for 2010-2023, and under two future scenarios: (left) production from existing fields, and demand falling in line with faster trends; and (right) production including new licences, and demand falling in line with current trajectory.