Moving from the EU Emissions Trading Scheme (ETS) to the UK-only ETS

What is different now the UK has left the EU-wide Emissions Trading Scheme and entered its own, UK-only version?

By Jess Ralston

@jessralston2Share

Last updated:

Putting a price on carbon is one way to reduce emissions. It incentivises organisations to reduce carbon emissions or otherwise face increased costs.

There has been a carbon pricing mechanism in place in the UK since 2002 in various forms, but mainly through the EU Emissions Trading Scheme (ETS) from 2005. Carbon prices can be levied through taxes, in which a price is set by Government, or by trading schemes which rely on the market to price carbon. Border adjustments to account for emissions in imports can be applied to both systems.

Many economists see carbon pricing as an efficient route to cutting emissions but there remain significant logistical and political difficulties in implementing carbon prices and ensuring that they are effective drivers of emissions reduction.

Emissions Trading Schemes

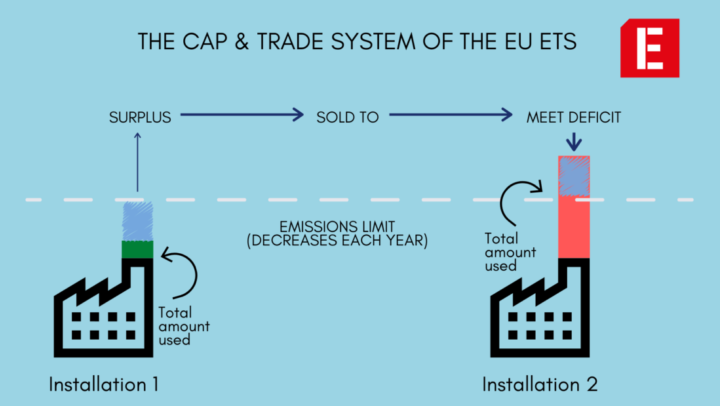

Trading schemes work by setting a ‘cap’ on emissions, which is lowered over time. Allowances to emit carbon can be traded, in theory sequentially decarbonising parts of the economy according to the costs of doing so.

The EU ETS is an EU-wide ‘cap and trade’ scheme that limits the maximum level of emissions for several highly polluting sectors. These are:

- power generation

- energy intensive industries like manufacturing of steel and iron, cement, chemicals etc

- aviation.

It has run in various ‘phases’ since 2005, covering more than 11,000 power stations and industrial plants (installations) that produce half of EU’s emissions.

The price of allowances varies depending on supply and demand, but in 2020 they ranged from €25 per tonne of carbon at the start of the year to a record high of €61 in August 2021.

The cap on the total number of allowances in the EU ETS system has been gradually decreasing over time. In 2013 there were around 2 billion allowances, which has been reduced by around 38 million allowances per year. In 2020 the cap on allowances was around 1.7 billion.

UK left EU ETS in January 2021

From 2020 onwards there will be a higher rate of allowance reductions each year (-2.2%) to reflect increased climate ambitions and need for accelerated decarbonisation.

When the transition period of the UK leaving the EU ended on 1st January 2021, the UK left the EU-wide ETS and entered its own UK-only version. By the UK leaving the EU ETS, the European system is set to shrink by around 11%.

Free allowances

In 2020, around 650 million free EU ETS allowances were allocated to installations that operate in a ‘global marketplace’ – essentially, businesses that could become less competitive if subjected to a carbon price, or if they have limited options for reducing carbon.

The practice of issuing free allowances has faced criticism in the past for giving a free pass to the most polluting industries. For example, the European Court of Auditors stated that free allowances ‘are not targeted at the right industries and are jeopardising the EU’s climate agenda by failing to maximise the decarbonisation potential of the ETS.’

The EU is planning to phase out free allowances in most industries between 2021 and 2030, starting from 30% in 2026, down to 0% in 2030. However, there are some exceptions, in industries that have a high chance of carbon leakage such as mining and a wide variety of manufacturing industries like metals, chemicals, food and clothes.

Carbon leakage occurs when organisations relocate their factories or supply chains outside the areas where carbon pricing applies. Industries deemed as having a ‘high chance’ of carbon leakage (listed above) will still be given 100% of their allowances for free for the time being. A disadvantage of this is that they will not have to buy allowances at auctions to cover their carbon emissions and so may not be as incentivised to cut emissions.

Brexit and the EU ETS

Out of the 11,000 installations that take part in the EU ETS, roughly 1,000 energy intensive industries and power stations are found in the UK. Additionally, 150 UK-administered aircraft operators take part in the EU ETS.

In Summer 2020, the UK Government set out its response to a consultation on the future of UK carbon pricing after the UK formally left the EU. The response committed to slightly lower allowance caps, 5% below the UK’s expected share of the EU-wide system over the period 2021 and 2030. The number of allowances that will be issued in the UK ETS in 2021 will therefore by 156 million, reducing by 4.2 million each year after.

The auction reserve price (ARP) - the minimum organisations would pay - for allowances in the UK ETS was set at £22 per tonne of carbon for the first actions to be held in mid-2021. However, this was surpassed significantly in the first auctions where carbon prices reached £44 (€51), similar to prices in the EU ETS over the same period. Since then the UK ETs price has risen in line with the EU ETS.

Since then further changes to the UK ETS have been outlined by the Government. For example, the recent Net Zero Strategy commits to 'exploring expanding the UK ETS to the two thirds of uncovered emissions' and to review the current free allocation policy as well as the scheme's evolution overall. It's likely the Government will choose to decrease the number of free allowances further to drive rapid emissions reductions, as the EU have committed to doing.

The Government has said that the changes following this consultation will be implemented no later than 2024, an indication of how seriously setting a trajectory for reaching the net zero goal is being taken.

The UK no longer participating in the EU ETS will make the market tighter. There will be fewer allowances for other organisations to purchase to cover their emissions. Models have shown that removing the UK’s allowance exports could increase the cost of allowances by €8/tCO2over the 2020s. A smaller market will also be less liquid, and therefore more susceptible to volatility and price swings.

UK installations leaving the EU ETS have until the 30th April 2021 to surrender their existing allowances. This may create mass offloading, particularly as UK installations are thought to own around 85 million allowances. This selloff could push allowance prices down by €4-5/tCO2 over the next five years.

There is scope to link up the EU and UK ETS in the Agreement made between the UK and the EU. There is a precedent for this as Switzerland linked their own ETS with the EU scheme on the January 1st 2020.

Linked systems would improve liquidity in both markets, as well as providing an example on how multiple cap-and-trade systems around the world can be brought into sync. Ultimately, the decision to link systems is a political one, and will be dominated by demands made by both sides if a discussion to do so begins.