Spring Budget: where is the UK in the green growth race?

After weeks of pressure from business, in Chancellor Jeremy Hunt’s Spring Budget the response to the IRA was hotly anticipated.

By Jess Ralston

@jessralston2Share

Last updated:

US President Joe Biden threw down the gauntlet with the Inflation Reduction Act (IRA), a $369bn green stimulus package, offering subsidies for everything from electric vehicles to solar panels.

The EU rose to the challenge with the Net Zero Industry Act, a loosening of Commission rules and re-allocating investment so Europe’s clean businesses can receive investments responding to those in America.

How about the UK? After weeks of pressure from business, in Chancellor Jeremy Hunt’s Spring Budget the response to the IRA was hotly anticipated.

But much has been left for the Government’s ‘Green Day’ – expected later this month – to secure investment and so the UK’s place in the race for green growth.

Help with bills

Hunt opened the Budget by announcing average energy bills will stick for the next three months at the equivalent of £2,500 a year. But, despite the cap, bills are still likely to rise by around £285 a year, ECIU analysis has found.

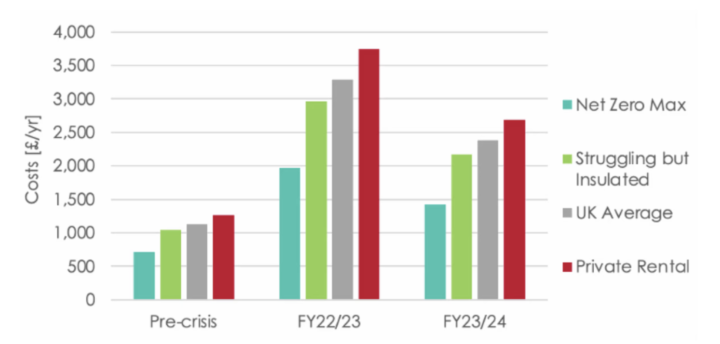

Price freezes will help, but are a sticking plaster for the short term. Without the help, households could see energy bills reach £3,3000 compared to an average of £1,100, pre-crisis.

Energy costs over the course of a year, for four scenarios – total costs paid by household and Government combined.

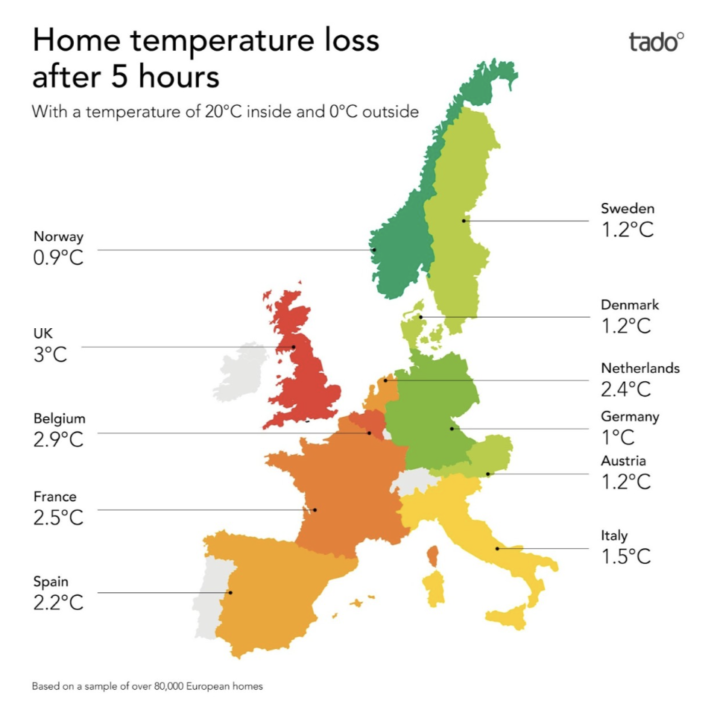

British bill payers are the worst off in western Europe following the gas crisis sparked by Russia’s war on Ukraine, according to the IMF. This is down to a high reliance on gas for power and poor energy efficiency; UK homes lose three times as much heat as German ones.

Insulating homes and investing in renewables could provide longer term bill relief, leaving many to hope these measures will be the focus of the Government’s Green Day.

Nuclear

Hunt’s answer to the IRA was in part Great British Nuclear. “Increasing nuclear capacity is vital to meet our Net Zero obligations,” he said.

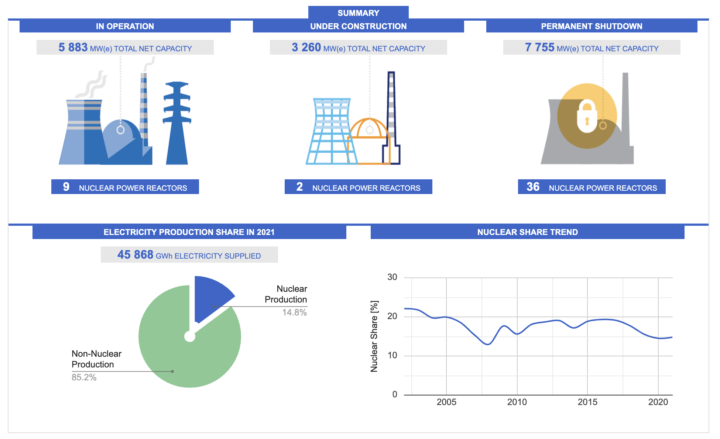

And nuclear energy will be reclassified as “environmentally sustainable” giving it the same investment incentives as renewables. Hunt hopes this and the launch of “Great British Nuclear” will set Britain up to harness a quarter of electricity from reactors by 2050.

Current UK nuclear capacity and production

There are also plans to launch a competition for Small Modular Reactors (SMRs).

SMRs are designed to cut down on the build time and cost of larger nuclear plants, which are expensive and laborious to construct. Theoretically, SMRs are mass produced in one location and then put together at their site, shaving off time and expense.

There are 50 SMR design concepts globally at various stages of development. The UK’s 2015 Autumn Budget also announced funding for SMRs, but these projects never came to fruition.

So, the question is what can be done differently this time round to ensure success? And what will the cost be?

Renewable energy

While supporting new forms of power generation like SMRs, the Budget threw a bone to the renewables industry by amending the enhanced Capital Allowances 130% ‘super-deduction’, which was due to end on 1st April, to ‘full expensing’ at 100% for another 3 years.

The kicker is in the detail, however, with long life assets of 25+ year lifetimes (e.g. wind turbines and building insulation), getting just a 50% rate for the first year.

The renewables industry has stated that this is ‘not enough to mobilise investment at scale in renewable energy’. They had called for parity with the oil and gas industry’s Investment Allowance.

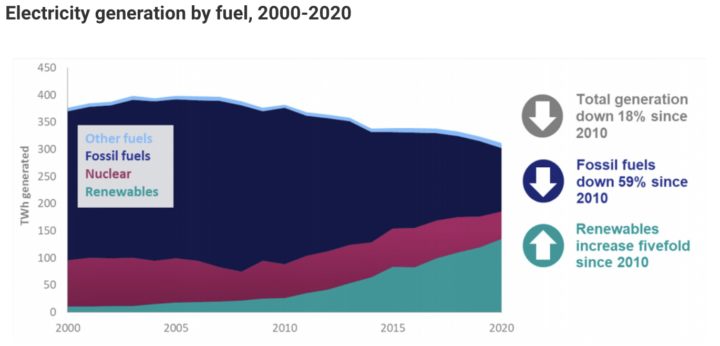

The Chancellor clearly likes renewables; he celebrated Britain being a leader in offshore wind. He claimed 90% of solar power was installed under Conservative governments in the last 13 years.

So industry is asking why not match this backslapping with greater investment? Perhaps further support will be announced on the Green Day. Renewables generators and investors will certainly hope so.

Carbon capture

The Chancellor also confirmed £20bn to carbon capture and storage, which the Government hopes will sequester 20-30 million tonnes of CO2 a year by 2030 and create 50,000 jobs.

Despite carbon capture and storage (CCS) technology trials being supported by the UK Government as early as the 1990s, evidence of it working at scale are relatively new[PC1] and internationally, numbers of projects are in the tens.

Carbon was successfully stored in the Danish North Sea for the first time earlier this month. This project aims to be storing 8 million tonnes of CO2 a year by 2030, so the Chancellor’s ambitions are high – likely spurred on by the tantalising opportunity that depleted North Sea fields offer the UK’s carbon capture industry.

Most net zero scenarios involve the use of carbon capture technology, mainly for industries that could struggle to cut emissions to zero, like chemicals refining.

But we've been here before; in 2015, Cameron's government cancelled a £1bn CCS competition just six months before it was awarded. The industry has clearly moved on since then, but to compete for CCS leadership this new investment needs to deliver results rapidly.

[PC1]Hasn’t it been around for yonks in one shape or form, just hardly ever brought to commercial scale?

Inheritance tax relief for farmland

Buried in the Budget was also a reference to a new call for evidence and consultation on the tax treatment of environmental land management and ecosystem service markets. This picks up on concerns from tax advisers and the farming industry that inheritance tax relief for farmland – known as Agricultural Property Relief or APR – may be creating a barrier to the land use change experts, and now Government, believe is required to get to net zero.

Combined with the support for nature-based solutions in the UK-Bangladesh Accord on Climate Change earlier this week, a technology within the remit of the UK Infrastructure Bank, the mood music is that HM Treasury is considering nature’s role in reaching net zero in more depth.

Green growth

While CCS and nuclear could play an important role in net zero, more hinges on transitioning to greener technology such as electric vehicles, insulating homes and unleashing Britain’s potential in renewable power.

CBI Economics and ECIU analysis found that the UK’s net zero economy is already worth over £70 billion to the economy. But Biden and the EU are seeking to soak up investment. The pressure is on for Green Day to allow the UK to take its place in the race.